If there’s one underdog in the ecommerce world, it’s Walmart. Earlier in 2024, all eyes were on TikTok Shops. We also hear a lot about Shein and Temu, and of course, the current king of online sales, Amazon. But seasoned ecommerce professionals always keep an eye on Walmart. The retail titan finally grabbed more attention with its Q2 results, showing over 20% growth in ecommerce YoY.

This raises an important question: How should brands prioritize sales channels? Should they focus on Walmart or TikTok Shops first? Let’s quickly review Walmart’s performance, see how its marketplace compares with Amazon, and explore what brands should do next.

Walmart’s Q2 2024 Performance

Let’s quickly go over the news: Walmart reported strong performance in Q2 2024, especially in ecommerce. Consolidated revenue grew from $161B in Q2 2023 to $169B, a remarkable 5% increase. Operating income grew even faster, up 8.4% YoY. Notably, according to John David Rainey, advertising and membership accounted for more than 50% of Walmart’s year-over-year operating income growth in the quarter.

But the real headline is Walmart’s ecommerce sales growth, which hit 21% globally in Q2 2024. CEO Doug McMillon highlighted, “Pickup is growing faster than our in-store or club sales, and delivery is growing even faster than pickup. Delivery accuracy and speed continue to improve.” Walmart Marketplace sales grew 32% YoY in Q2, showing how valuable this channel is for brands. So, is Walmart Marketplace becoming the new Amazon for brands?

Is Walmart the New Amazon? How the Two Titans Compare

With Walmart’s impressive growth in ecommerce, is it fair to say Walmart is the next Amazon? Amazon still leads in this race with a broader reach. Beyond just ecommerce, Amazon is on track to surpass Walmart as the #1 US retailer. Amazon ended 2023 with $575B in revenue, compared to Walmart’s $648B. However, Walmart is improving fast and has several strengths that could help it compete with Amazon effectively.

First, let’s talk logistics. During the Q1 earnings call, President and CEO Doug McMillon said Walmart delivered 4.4 billion items with either same-day or next-day shipping speeds in the U.S. over the past 12 months. They also reduced delivery costs by 40%. With over 4,500 stores in the US, Walmart’s extensive network boosts delivery speed and efficiency—one of the top reasons people love Amazon Prime. But now, Amazon isn’t the only one offering this speed.

Walmart’s product assortment is also expanding extremely fast. We used to say “Anything you can think of is sold on Amazon”, the same thing is becoming a reality with Walmart. The marketplace has grown from 100,000 sellers last year to over 150,000. Sure, this is not even 10% of Amazon’s 1.9 million sellers, but the growth is impressive. These new sellers are bringing tons of new products to the marketplace. Walmart even offers U.S. inbound shipping to sellers in China, so we can expect even more items.

When it comes to pricing, it’s hard to tell which platform is cheaper due to the lack of comprehensive data. However, studies of a few dozen items suggest prices are similar on average, with occasional large differences. In a personal experiment last year, I found Walmart slightly cheaper on average (you can check it out here: Case Study on Walmart Marketplace).

We’ve covered delivery speed, product assortments, and pricing—great for customers, but what about sellers? What makes Walmart Marketplace so attractive to brands and entrepreneurs?

In my opinion, the answer lies in Walmart Fulfillment Services (WFS) and its competitive fee structure. WFS is the equivalent of Amazon FBA, making it much easier for sellers to offer their products to customers. No need to spend time and resources on order fulfillment, and the rates are competitive compared to 3PL companies. Yes, there are restrictions, but I see this program as a key reason Walmart is now attracting thousands of new sellers each month.

Finally, let’s focus on the two main expenses when selling on the marketplace using WFS: referral fees and fulfillment fees. Comparing these fees across multiple marketplaces, Walmart and Amazon are pretty aligned.

Here’s a simplified case study comparing profitability across three items, focusing on referral and fulfillment fees:

It appears that:

1 – The referral fees are the same across three categories : Jewelry, Shoes and Electronics

2 – Amazon’s FBA fee are slightly cheaper for light items, and more expensive for bulkier items

3 – The difference can be significant for the heaviest item : WFS fee is $5 lower for a printer

From this comparison, it’s clear that Walmart is very competitive for sellers. The main thing missing currently is traffic—Amazon still dominates in that category.

Walmart vs TikTok Shops: Which Channel Should Brands Address After Amazon?

When it comes to sales channels, most brands start with Amazon, and sometimes with a DTC channel. The next step often raises the question: Should brands address Walmart or TikTok Shops first in 2024?

My stance is pretty clear: Walmart Marketplace is the low-hanging fruit for those already successfully selling on Amazon. I believe Walmart should be prioritized over TikTok Shops until the initial setup is done. This sales channel works similarly to Amazon, and it’s easy to reuse Amazon content and data to list products on Walmart. I also find the system to be less complex and require less daily maintenance. Yes, volumes are lower (most brands should expect 1-5% of their Amazon sales on Walmart), but it’s relatively easy and low-risk.

Of course, this assumes brands are already successful on Amazon. Walmart Marketplace is competitive—there are far fewer sellers than on Amazon, but they have to fight for a smaller amount of traffic. Competition is only increasing, with prices at the same level as Amazon’s. Additionally, Amazon and Walmart Marketplace have similar cost structures. If a company is losing money on Amazon, they’re likely to lose money on Walmart Marketplace too. Brands struggling on Amazon should fix their issues before expanding to Walmart Marketplace.

So, what about TikTok Shops? TikTok Shops is a relatively new channel, still much smaller than Walmart. TikTok Shops reported $16B in GMV in 2023, compared to $82B for Walmart Marketplace. On the other hand, TikTok Shops has 500,000 sellers, making it theoretically more competitive than Walmart.

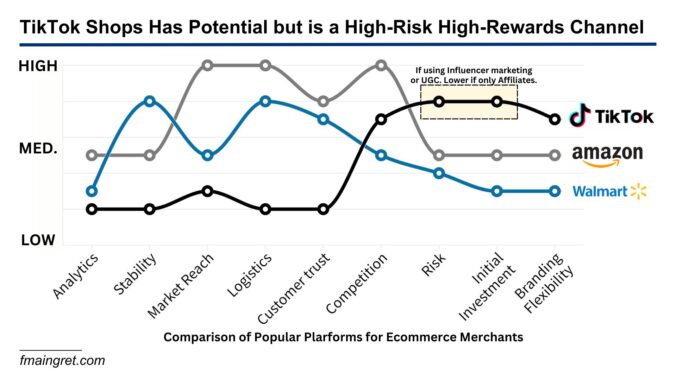

TikTok Shops is a different beast altogether. Amazon and Walmart are optimized for product searches; it’s not terribly difficult for a brand to attract traffic and generate sales. On the other hand, TikTok Shops is optimized for content and product discovery. This means brands need content (either organic, through ads, or influencers/affiliates) to effectively sell their products. This can be a significant investment with no guarantee of profits. Amazon advertising is more predictable, and most brands with a good value proposition can generate sales easily. But TikTok feels more like a winner-takes-all situation—many campaigns and creatives will yield zero results, while a rare ad might generate a ton of revenue.

TikTok Shops is still a very new platform and isn’t as mature as Walmart or Amazon. They don’t have fulfillment services like FBA or WFS (which can be a barrier for many businesses), have limited analytics functions, a lower market reach, and are constantly evolving. We don’t even know how long it will be around. On the other hand, it can be a massive opportunity for brands with a strong social media following or those seeing great results from content and influencer marketing. This is especially true for emotionally driven purchases.

For these reasons, I recommend brands that already sell on Amazon address Walmart first, then consider TikTok Shops if they have the resources and the right products. Focusing on a DTC website can be another option, but that’s a whole different conversation.

Conclusion

Walmart’s Q2 performance shows the company can thrive in the ecommerce space. Often overshadowed by giants like Amazon and the new shiny objects like TikTok Shops, Walmart has consistently proven to be a major player.

Walmart’s marketplace and logistics capabilities are strong reasons for brands to prioritize this channel. While TikTok Shops offers an exciting opportunity, especially for brands with a strong social media presence, Walmart’s established infrastructure, lower risk, and ease of entry make it the clear next step for those already successful on Amazon. Walmart may not yet rival Amazon in size, but its consistent growth and strategic investments suggest it’s a platform brands cannot afford to ignore.