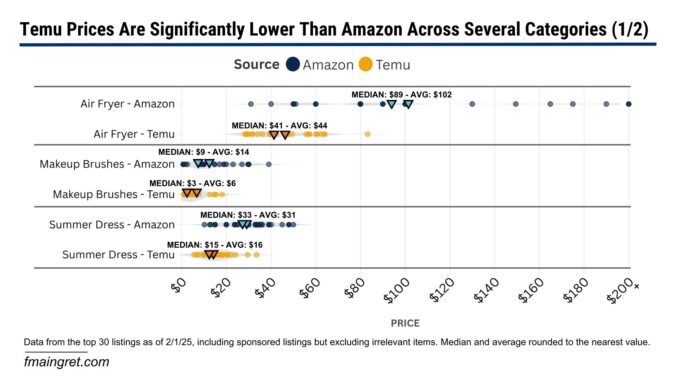

If you ask your friends and family whether Temu is cheaper than Amazon, I guarantee everyone will say yes. But how much cheaper are we talking about? 10%? 50%? I was curious to figure this out, and it was difficult to find relevant data. I was not interested in looking at the marketplace as a whole because no one does 100% of their shopping on Temu or Amazon. Instead, I looked at specific items people might be shopping for and compared the prices between the two marketplaces.

Another thing you’d hear from your friends is that items from Temu take a very long time to arrive. However, for over a year, Temu has had plans to open warehouses in the U.S. and Europe. The company stated that “it will eventually process as much as 80 percent of European sales through these local warehouses.” Did Temu really follow through, or are most purchases still shipped directly from China?

Temu vs Amazon – By How Much is Temu Cheaper?

The methodology I used is pretty simple. I searched for six different keywords on both platforms. For each keyword, I compared the prices between Amazon and Temu for the top 30 results, including sponsored listings but excluding irrelevant results.

At first glance, it is obvious that Amazon tends to be more expensive. For every search term, both the median and the average price on Temu are significantly lower than on Amazon.

Another interesting fact is that Temu’s prices seem to be concentrated in the lowest values, while the spread for Amazon prices is much wider. This is due to Temu shoppers mostly looking for the best deals on off-brand items, while Amazon has a mix of unbranded and branded products at premium prices. Another reason is that Temu’s algorithm may have a stronger tendency to push higher-priced items down the search results, while Amazon allows higher prices in the first search results if the sales volume and velocity are high enough or if they are sponsored listings.

Where Does Temu Ships From?

For a long time, Temu shipped directly from China, using the de minimis rule and postal agreements to minimize duties and shipping costs. While Amazon is experimenting with the direct-from-China model with Haul, Temu announced over a year ago its plans to open local warehouses to ship domestically. So for our six items, where do they come from?

I was very surprised that for each search term, the majority of products on Temu shipped from local warehouses with very reasonable delivery times (seven days, sometimes less).

Of course, Temu did not stop shipping from China. If you scroll down long enough, you’ll see a lot more items shipping from overseas. But it is clear that they prioritize local products at the top of the search results. This could be because these orders are more profitable for them, but also because customers are pushing for faster shipping, even if prices are a little higher. Speaking of pricing, it is interesting to note that even though most items now ship from local warehouses, prices are still much lower than on Amazon (see charts above).

Conclusion

Temu is cheaper than Amazon, but the real question is—by how much? Based on the data, Temu consistently offers lower prices, with its products concentrated in the lowest price ranges, while Amazon sells a wider spread that includes premium brands.

Delivery times on Temu have also improved now that the majority of first-listed products now ship from local warehouses. While Temu still relies on overseas shipping for some items, the platform is clearly prioritizing speed alongside affordability. In conclusion, Temu isn’t only cheaper, it’s evolving fast, maybe becoming a more competitive alternative to Amazon than most people would expect.