Note: This is satire, if you’re looking for legitimate business advice, this isn’t the right article for you. This is more of a guide to help aspiring entrepreneurs avoid obvious scams.

In a world where everyone is chasing the next big thing, finding meaning in your work is very important for your well being. What better way to do this than by empowering others with the financial freedom to fulfill their dreams? Instead of just building a billion-dollar business for yourself, why not teach others how to achieve the same success?

It is more than just a job, it is a mission to make the world a better place, one success story at a time. And today, I will give you my secrets to become a business guru in no time.

Continue readingIf you’ve been following my content, you often hear me say building a strong brand is one of the most important things in today’s business environment. And one of the signs you have a strong and successful brand is when you start seeing counterfeit products.

According to OECD data, the global trade in counterfeit goods in 2023 was $1.023 trillion, or 3.3% of the total global trade. And despite efforts from brands and marketplace operators, these products are all over merchant websites, including some of the most popular.

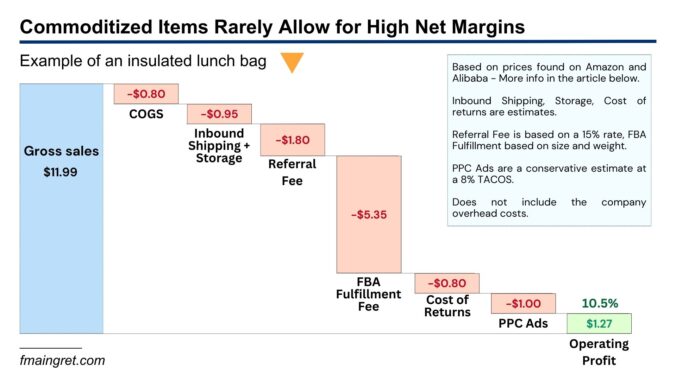

Continue readingI recently saw an intriguing article in my recommendations. It was a guide on how to find products on Alibaba to resell on Amazon. I wondered why Google would recommend articles from 2017? But no, the article was published recently by a major company that sells market research software.

I get it, everyone is looking for the easy, quick, and risk-free way to get rich. And people have been selling that dream since commerce was a thing. We’ve seen it with dropshipping, with “Alibaba to Amazon” private labeling, or with the millions of pyramid schemes out there. Hell, I am sure people in ancient Greece were selling courses on investing in olive oil and wine.

Even though the article doesn’t present itself as a “get rich quick” guide, I found it overly optimistic. I don’t blame the company; it was well-written and probably does a great job at selling their software. And it isn’t misleading either; there is a lot of good and useful info in there. But because I know there are aspiring entrepreneurs reading my content, I’d like to discuss the risks of this strategy. The market has changed drastically since people started selling products sourced from Alibaba on Amazon, and I think it is necessary to understand these changes.

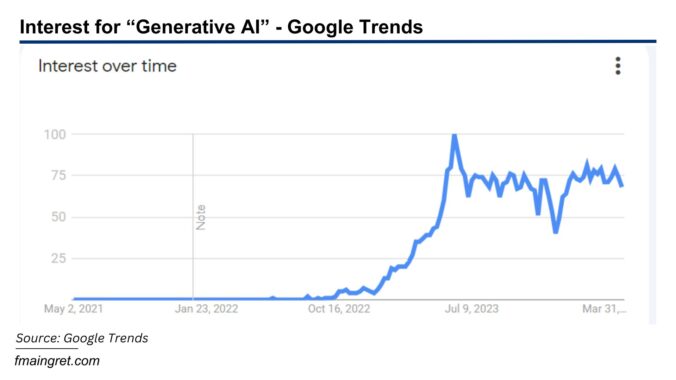

Continue readingWe’ve all used generative AI to do our homework, write an email, or create marketing assets. But the technology is much more than that. When I first tried ChatGPT, I wondered how it would impact e-commerce. Before I thought of copywriting or improving images, I thought that we would very shortly see Amazon saturated with AI-generated books.

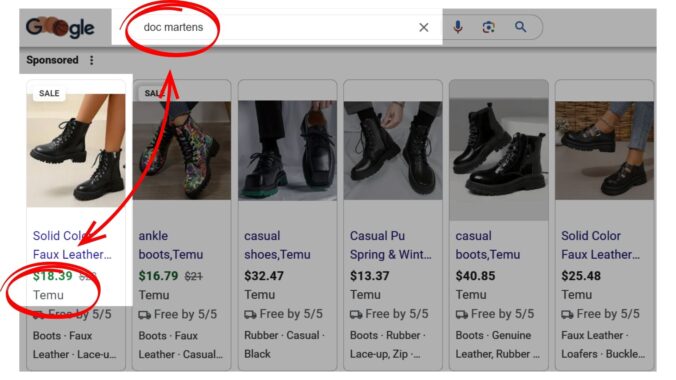

Continue readingThere has been a lot of controversy over Temu, Shein, and intellectual property laws. There are numerous reports of brands and independent designers claiming the Chinese giants have stolen their designs to sell similar lower-priced items online.

Recently, the footwear brand Dr. Martens is suing Temu for another reason. Dr. Martens claims Temu is manipulating Google searches to display their product alongside Dr. Martens shoes.

I am not an IP lawyer, but I have some difficulties seeing how this lawsuit stands a chance. While there might be some IP issues with Temu, I don’t see this lawsuit going very far, and I’d like to review it from an e-commerce professional point of view. Now, if you are a lawyer, I’d love to hear your opinion as I may miss important details that require extensive knowledge of IP laws.

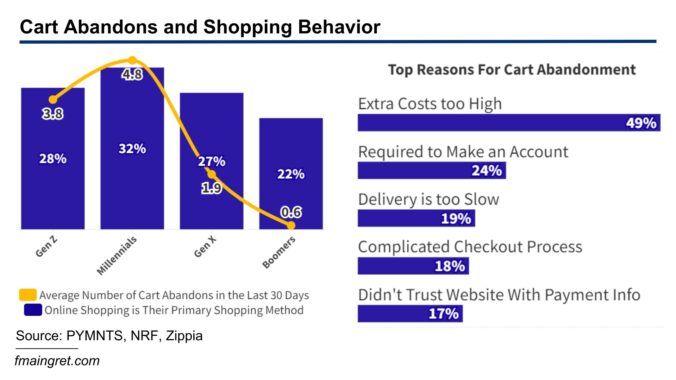

Continue readingHaving a customer abandon their cart during checkout is like running a marathon, but spraining your ankle a few yards before the finish line. PYMNTS recently released a report on cart abandonments, and I think retailers should pay close attention to the numbers.

Millennials are the generation that shops online the most and has abandoned more carts recently than other generations. Millennials abandoned 8 times more carts in the last 30 days than boomers. Gen Z isn’t very far behind. It appears that older customers are much less likely to abandon their carts.

It is clear that each generation behaves differently when shopping online. Retailers that do not address cart abandon rates are leaving money on the table. This issue will be more and more important as Gen Z and millennials gain more purchasing power.

Now, let’s see why customers are leaving before completing the purchase and what can be done to lower cart abandon rates.

Continue reading

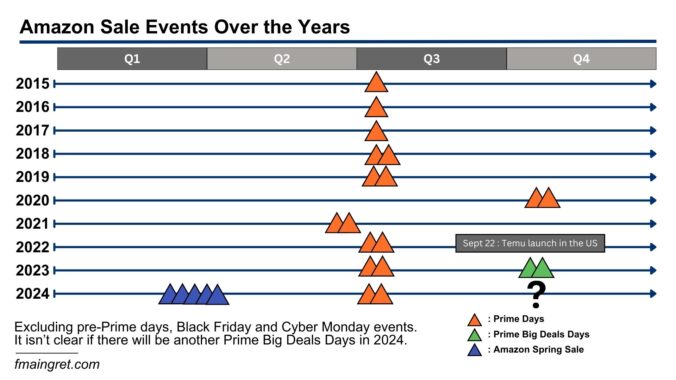

How Many Amazon Sales are Too Many? Why I Think Amazon Does More Sales Events than Ever and Why It Isn’t Sustainable.

As a kid, going to a fast-food restaurant was an exciting experience. After all, I didn’t get the chance to get a Happy Meal very often, and I was always looking forward to my next visit to Mickey D’s. As an adult, however, I couldn’t care less. If I crave a Big Mac, I can drive anytime to the nearest McDonald’s. That’s exactly how many customers feel when a retailer does too many flash sales; it doesn’t feel special anymore.

As I explained in a recent LinkedIn post, Amazon seems to keep doing more and more sales events. We were used to Prime days once a year in the summer, but in the past year, we have also experienced Prime Big Deal days last fall, and now Amazon’s Spring sale just ended.

Today, I’d like to discuss this shift in Amazon’s strategy. The e-commerce landscape has changed a lot since the pandemic, and Amazon had to update its strategy to maintain its market share. In a second part, I want to discuss the drawbacks of this strategy and how it may affect the e-commerce giant negatively.

Continue reading

Ecommerce and Social Media are Fueling the Ultra-Fast-Fashion Machine – Can the Same Technologies Also Save Us From it?

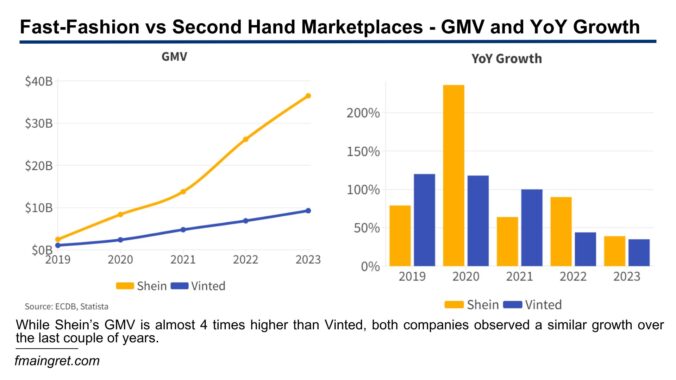

In a previous article, I wrote about ultra-fast fashion, specifically on how France is trying to limit its impact on the environment with new regulations. We’ve seen how unsustainable fast fashion can be, with Americans tossing out a whopping 34 billion pounds of used clothes each year—that’s over 100 pounds per person!

What can be done about Shein? Let’s be realistic, Shein is the target of France’s proposed regulations. Bans or taxes sound good on paper, but they don’t completely eliminate the problem and tend to frustrate customers. Making local brands cheaper so they can compete with Shein (through new processes, innovation, or worse, lower taxes or subsidies) may help local economies, but this wouldn’t do much in terms of sustainability. Greenwashing and shaming customers isn’t ideal either, and won’t win any fans.

Are we stuck in a never-ending cycle of buying and trashing clothes, until we drown in used t-shirts? Thousands of new designs are released every day, and Shein sales are supercharged by influencers and social media. However, I believe we shouldn’t throw in the towel just yet. Ecommerce has come a long way in the last 20 years, and there are some impressive innovations that could help us shop smarter and more sustainably. So let’s see what our options are, and how some successful entrepreneurs are already addressing the fast-fashion problem by offering solid alternatives.

Continue reading