As a kid, going to a fast-food restaurant was an exciting experience. After all, I didn’t get the chance to get a Happy Meal very often, and I was always looking forward to my next visit to Mickey D’s. As an adult, however, I couldn’t care less. If I crave a Big Mac, I can drive anytime to the nearest McDonald’s. That’s exactly how many customers feel when a retailer does too many flash sales; it doesn’t feel special anymore.

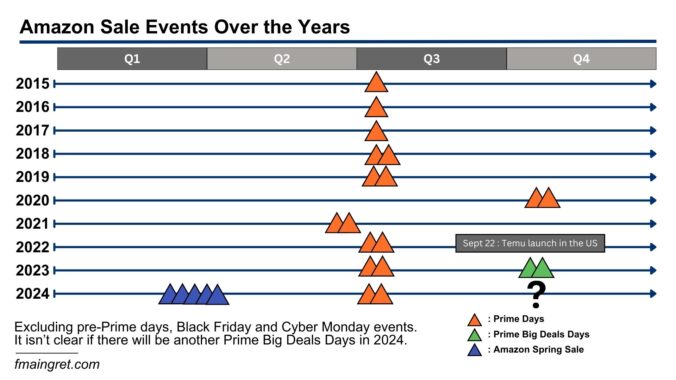

As I explained in a recent LinkedIn post, Amazon seems to keep doing more and more sales events. We were used to Prime days once a year in the summer, but in the past year, we have also experienced Prime Big Deal days last fall, and now Amazon’s Spring sale just ended.

Today, I’d like to discuss this shift in Amazon’s strategy. The e-commerce landscape has changed a lot since the pandemic, and Amazon had to update its strategy to maintain its market share. In a second part, I want to discuss the drawbacks of this strategy and how it may affect the e-commerce giant negatively.

Why Would Amazon Plan More Sales than Ever?

Unless you live under a rock, you’ve heard of Temu. And if you’ve shopped on Temu, you’ve probably noticed something interesting: every day feels like Prime days. A major part of Temu’s value proposition is the daily ultra-low prices. We now also have Shein, shaking the massive fashion industry with its unbeatable prices and thousands of new designs released every day.

Amazon makes it clear part of their strategy is to offer low prices. It’s been the case historically (for example, when Amazon takes the buy box away from sellers that list their product at a lower price on another sale channel), but we have seen recent moves to incentivize sellers to lower their prices. For example, Amazon lowered referral fees for low-priced clothing items and seems to make it very easy for Chinese sellers to list their items on the marketplace. It isn’t surprising that Amazon also organizes these flash sales events more frequently and asks sellers to offer discounts in exchange for increased traffic on the marketplace.

Another interesting reason why Amazon might do it is to retain Prime members. Prime members tend to have a much higher customer lifetime value than non-members. In an era where rising competitors already have their own membership (such as Walmart+), or are in the process of developing one (Target, for example), it is important for Amazon to keep their customer base. Prime days used to be an exciting event that created a lot of brand awareness for Amazon, and I believe these new sales events might be ways to recreate the old Prime days magic.

Why Multiplying Prime Days Can be a Difficult and Risky Strategy?

According to a recent PYMNTS survey, 42% of customers did not participate in this Spring sale because they simply didn’t know the sale was happening! Going back to my first point in the introduction, it is clear that the more sales happen, the less special they feel.

Let’s look at the recent Spring sale, which ran from March 20 to March 25. According to the same survey, 28% of U.S. consumers participated in the Big Spring Sale. This is much less than the 64% of consumers who declared shopping on Amazon during the 2020 Prime days. We are now approaching Prime days 2024, and I am looking forward to seeing how they compare to the past editions. The summer Prime days remain the king of internet flash sale, but too frequent sales are confusing for consumers. I believe this is one of the reasons why the retailer Zulily, that abused flash sales, went out of business recently.

Another problem is that Amazon relies a lot on its 3rd party sellers. In Q4 2023, they contributed to 61 percent of items sold on Amazon. And if more and more sellers refuse to participate in Prime days or other events, what can Amazon do? I’d love to see statistics on this, but I have seen many anecdotal reports of 3rd party sellers seeing little to no return on investment when participating in Prime days.

Amazon’s fees are increasing year after year, while the marketplace is becoming extremely competitive. Some sellers are seeing their margin shrink and simply can’t afford to offer large discounts. One may argue that it is acceptable to sell at a loss for a few days, hoping that customers will come back later and pay full price. But I believe this is a losing strategy in most categories. Many Prime days customers are very price-sensitive and aren’t brand loyal. They shop for the best available deals, if a brand increases their price, customers will go to their lower-priced competitors.

Finally, flash sales on Amazon can trigger a response from other retailers like Shein or Temu. We’ve seen Walmart throw their Holiday Kickoff sale in response to Amazon’s Big Deals days. Temu can easily offer even larger discounts during Prime days. Competing on price is difficult, and while Amazon has a lot of name brand customers’ value, off-brand items make up for most of their listings.

Conclusion

It is clear that the new sales events Amazon organized are not as special as the original Prime days. Customers now have more options than ever to shop online, and I can see why Amazon wants to keep their attention. However, this can create a confusing experience for customers, and third-party sellers may not be willing to participate like they did in the past. I look forward to seeing how the 2024 Prime days go and how competitors will respond.

https://influencermarketinghub.com/amazon-prime-day-stats/#toc-1