Tag: amazon (Page 1 of 4)

You may have heard recently about Amazon overtaking Walmart’s revenues for the first time.

But Walmart is far from being out of the game; I would say they are a serious competitor in ecommerce.

In 2024, Walmart delivered five billion items on the same day they were ordered, twice as many as in 2023. Amazon does not communicate its numbers, but the growth is impressive.

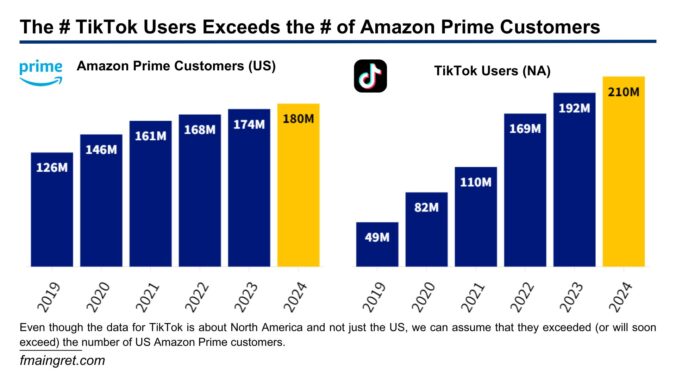

Over the last few years, Amazon has been throwing s**t at the wall to see what sticks. Not everyone can be Amazon, but not everyone can be TikTok either. So, I’m not surprised to see that Amazon is shutting down Inspire, their TikTok-like feed of shoppable videos posted by influencers and brands.

As Paul Drecksler explained in a recent post, people go to TikTok for entertainment, not just with the intent to shop, and Inspire lacked the entertainment part. I believe very few people are looking for Amazon’s version of QVC, and many people tend to rely on existing social media for product discovery.

Another reason for this failure, in my opinion, is the lack of influencers on the platform. People want to see content from their favorite creators, and Amazon struggled to attract talent. They were mocked for the low rates they offered: at one point, Amazon said they would pay influencers $25 per video, with a payout cap of $12,500 for influencers submitting up to 500 videos.

Amazon is great for capturing customers at the bottom of the funnel, but when it comes to product discovery, I think there’s a lot of progress to be made. Maybe a partnership or an acquisition would work better, because I don’t see how they could turn their shopping app into a media platform that can compete with TikTok or Instagram.

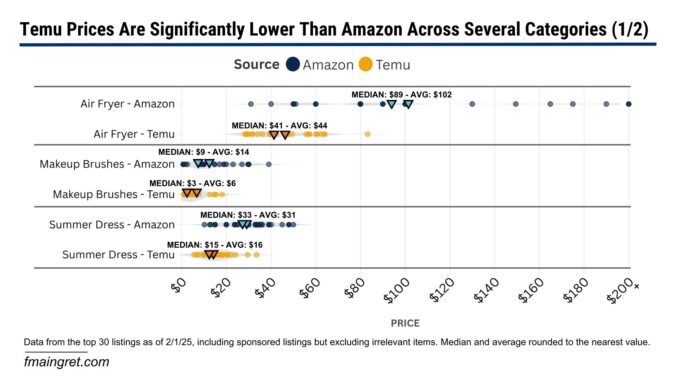

If you ask your friends and family whether Temu is cheaper than Amazon, I guarantee everyone will say yes. But how much cheaper are we talking about? 10%? 50%? I was curious to figure this out, and it was difficult to find relevant data. I was not interested in looking at the marketplace as a whole because no one does 100% of their shopping on Temu or Amazon. Instead, I looked at specific items people might be shopping for and compared the prices between the two marketplaces.

Another thing you’d hear from your friends is that items from Temu take a very long time to arrive. However, for over a year, Temu has had plans to open warehouses in the U.S. and Europe. The company stated that “it will eventually process as much as 80 percent of European sales through these local warehouses.” Did Temu really follow through, or are most purchases still shipped directly from China?

Temu vs Amazon – By How Much is Temu Cheaper?

The methodology I used is pretty simple. I searched for six different keywords on both platforms. For each keyword, I compared the prices between Amazon and Temu for the top 30 results, including sponsored listings but excluding irrelevant results.

At first glance, it is obvious that Amazon tends to be more expensive. For every search term, both the median and the average price on Temu are significantly lower than on Amazon.

Another interesting fact is that Temu’s prices seem to be concentrated in the lowest values, while the spread for Amazon prices is much wider. This is due to Temu shoppers mostly looking for the best deals on off-brand items, while Amazon has a mix of unbranded and branded products at premium prices. Another reason is that Temu’s algorithm may have a stronger tendency to push higher-priced items down the search results, while Amazon allows higher prices in the first search results if the sales volume and velocity are high enough or if they are sponsored listings.

Where Does Temu Ships From?

For a long time, Temu shipped directly from China, using the de minimis rule and postal agreements to minimize duties and shipping costs. While Amazon is experimenting with the direct-from-China model with Haul, Temu announced over a year ago its plans to open local warehouses to ship domestically. So for our six items, where do they come from?

I was very surprised that for each search term, the majority of products on Temu shipped from local warehouses with very reasonable delivery times (seven days, sometimes less).

Of course, Temu did not stop shipping from China. If you scroll down long enough, you’ll see a lot more items shipping from overseas. But it is clear that they prioritize local products at the top of the search results. This could be because these orders are more profitable for them, but also because customers are pushing for faster shipping, even if prices are a little higher. Speaking of pricing, it is interesting to note that even though most items now ship from local warehouses, prices are still much lower than on Amazon (see charts above).

Conclusion

Temu is cheaper than Amazon, but the real question is—by how much? Based on the data, Temu consistently offers lower prices, with its products concentrated in the lowest price ranges, while Amazon sells a wider spread that includes premium brands.

Delivery times on Temu have also improved now that the majority of first-listed products now ship from local warehouses. While Temu still relies on overseas shipping for some items, the platform is clearly prioritizing speed alongside affordability. In conclusion, Temu isn’t only cheaper, it’s evolving fast, maybe becoming a more competitive alternative to Amazon than most people would expect.

I’ve made many questionable investment decisions over the years, but buying Walmart stock is not one of them. Don’t worry, I’m not here to give personal finance advice, but rather to talk about the retail giant and how it compares to the current king of ecommerce, Amazon.

For many years, Amazon has dominated the ecommerce world, performing much better than all of its competitors. But 2024 was different: Walmart is no longer flying under the radar and is getting more attention from marketers. But how big is it really?

Continue reading

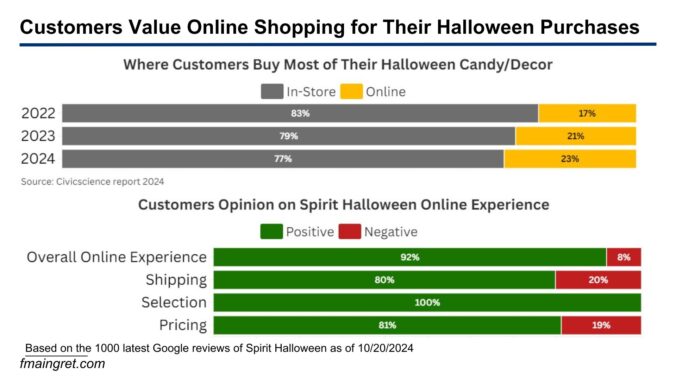

Zombies and Witches Favor Online Shopping: How Spirit Halloween’s Online Strategy Meets Their Expectations

If you live close to a large city, you’ve probably seen all these Spirit Halloween stores popping up recently. It’s impossible to miss them with their bright orange signs. I find it impressive that a company can generate enough revenue during the Halloween season to have the resources to open all of these temporary locations. But what’s even more impressive is that, even when operating within such a short time frame, they place a heavy focus on the online experience.

Let’s see how this company operates and review some key parts of their online strategy. Spirit Halloween recently added some interesting shipping options and seems to perform well online. Halloween is certainly an interesting time of year for businesses, and I thought it would be insightful to examine one of these extremely seasonal businesses that succeed online.

Continue readingIs this the end of $0.50 funny cat socks and $5 disposable dresses? There’s been a lot of buzz over the last year about the de minimis rule, which has been exploited by companies like Shein and Temu. Now, the Biden-Harris administration is pushing for new regulations.

It seems like a direct jab at the two Chinese giants, but these changes would affect a lot more players. How bad could it be for Temu and Shein? And who will lose or benefit from the elimination of the de minimis rule? Let’s find out.

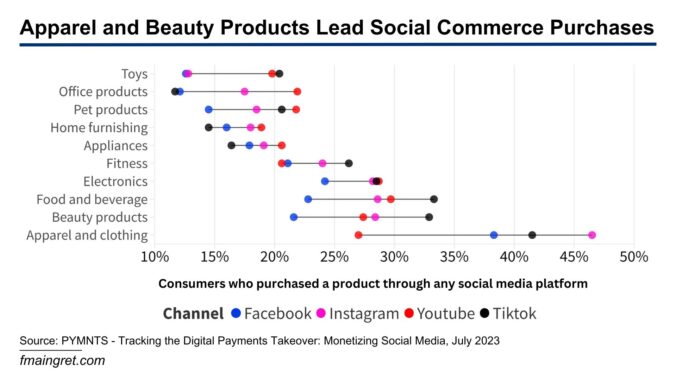

Continue readingFollowing my recent post about the TikTok-Amazon partnership, I did a little more research. I analyzed data from the PYMNTS report, “Tracking the Digital Payments Takeover: Monetizing Social Media,” and plotting it on charts revealed something big.

Continue reading

TikTok Partners with Amazon – Sign of a Major Ecommerce Change or a Small Piece of TikTok’s Social Commerce Strategy?

Is there a better way to break our attention spans and budgets than a partnership between Amazon and TikTok? The king of ecommerce is teaming up with the most addictive social media app to allow TikTok users to purchase items directly from Amazon without leaving the app.

Unfortunately, we don’t have all the details on this partnership yet, but people are already speculating on how it will impact the ecommerce world. Let’s first look at what we know about it and what the potential consequences could be for customers, brands, and the future of ecommerce.

Continue readingLast week, I came across a great article by Spencer Soper in Bloomberg (link below, I recommend reading it) about how Amazon sold a returned used diaper, and hurt an American small business relying on the FBA program. I found that this story is the perfect example of the shit (no pun intended) Amazon sellers have to deal with every day. The process of the incident is complex, with many actors and tasks involved, and I’d like to break it down to identify what went wrong and what could have been done better. Then, I’ll give my opinion on what I think was the main issue here, and how frustrating it can be for millions of sellers.

Continue reading