I recently saw an intriguing article in my recommendations. It was a guide on how to find products on Alibaba to resell on Amazon. I wondered why Google would recommend articles from 2017? But no, the article was published recently by a major company that sells market research software.

I get it, everyone is looking for the easy, quick, and risk-free way to get rich. And people have been selling that dream since commerce was a thing. We’ve seen it with dropshipping, with “Alibaba to Amazon” private labeling, or with the millions of pyramid schemes out there. Hell, I am sure people in ancient Greece were selling courses on investing in olive oil and wine.

Even though the article doesn’t present itself as a “get rich quick” guide, I found it overly optimistic. I don’t blame the company; it was well-written and probably does a great job at selling their software. And it isn’t misleading either; there is a lot of good and useful info in there. But because I know there are aspiring entrepreneurs reading my content, I’d like to discuss the risks of this strategy. The market has changed drastically since people started selling products sourced from Alibaba on Amazon, and I think it is necessary to understand these changes.

More and More Niches Are Getting Saturated

Amazon is forecasted to represent 40% of all US ecommerce sales in 2024. Their marketplace attracts millions of customers every day. And they made it extremely easy for people to start selling on their platform.

As a result, thousands of sellers are joining Amazon every single day. And it isn’t much different from Onlyfans: people think it is easy to make millions selling pictures of their feet, while in reality, only a very small percentage of people can make a living off selling content. On Amazon, only 6% of sellers are doing over $50,000 in monthly sales, and 2% do more than $100,000. So the market is extremely saturated and competitive.

You might object, “But I’d be okay making $50,000 a month, or even less.” Here comes the second problem with Amazon: profitability.

Let’s go back to Alibaba for a second. As you probably already know, this website allows you to find suppliers and manufacturers for all kinds of products: camping tents, water bottles, coloring books… Even questionable trademarked items like Dallas Cowboys socks, or purses that are strangely similar to luxury designers items. If you can buy these items, anyone can. Which contributes to “commoditization”: the process of turning once unique products or services into standardized items for consumers, where the main differences are pricing and customer service (customer service is almost irrelevant on Amazon, as the platform does it for you most of the time). And as you can expect, the more sellers are listing an item, the lower prices (and profitability) become.

Let’s look at an example from an article I published months ago. In five years, the number of listings for massage guns went from one to over 200! And as time goes, new entrants list their products at lower and lower prices. As of 1/1/24, the average price of massage guns is $92. Sellers who released their items in 2020 are now (as of today) selling their product for about $98. The difference in prices may not seem obvious, but let me show you another chart to evaluate how this increased competition forced the first sellers to slash their prices.

The five stars on the chart represent the top 5 selling massage guns, when they were launched. At launch, they were selling at 100% of their initial listing price. As of 2024, they sell for an average of only 63% of their initial listing price. In other words, they had to discount their price by 37%. Not to mention that in recent years, inflation increased all of their costs, from logistics to advertising, and probably even their Cost Of Goods Sold.

At this point, you may argue that many sellers are using skimming pricing strategies to maximize their profit and find the right price point. I agree that in some cases, skimming is an effective strategy. But I believe that in many niches, it’s been a race to the bottom. To prove my point, let’s look at something even scarier for sellers.

Your Main Competitor Just Became a Lot Scarier

Up until recently, buying items on Alibaba to resell them on Amazon was a relatively safe strategy. Asian manufacturers and trading companies would provide the goods, and ship them to Amazon fulfillment centers and US merchants. Everything changed during the pandemic when more and more Asian suppliers started selling directly on Amazon.

I won’t get into the theories that many US entrepreneurs share about Amazon favoring Chinese sellers over local businesses. But you can guess what the consequences are: you can’t compete on pricing with your own supplier.

Let’s take the fictional example of Joe, a new entrepreneur wanting to resell items from Alibaba on Amazon. We’ve all noticed that fast food prices are through the roof. People are getting tired of spending $15 for unhealthy food, and I can’t blame them. Joe believes more and more people will start taking their own lunch to work: selling insulated bags to carry lunch might be a good opportunity.

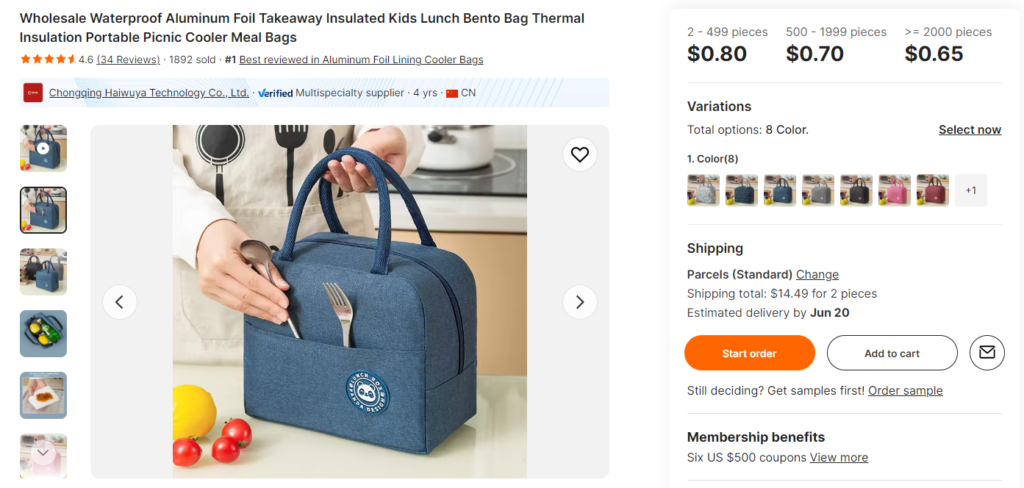

Joe finds that the market isn’t too competitive for now. He researches products on Alibaba and finds this one for $0.65 to $0.80 per unit.

Wow, if he can sell it for $20, that is a gross margin of over 95%! How can you not make money with killer margins like that? He did his research and found he would make a 54% operating profit, over $10 per unit sold.

After running the business for a few weeks, he realizes a few things:

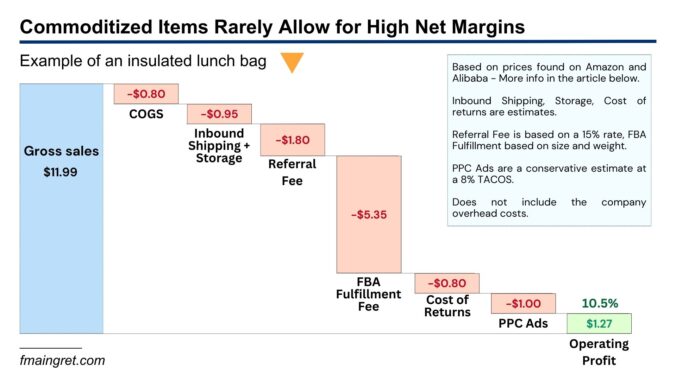

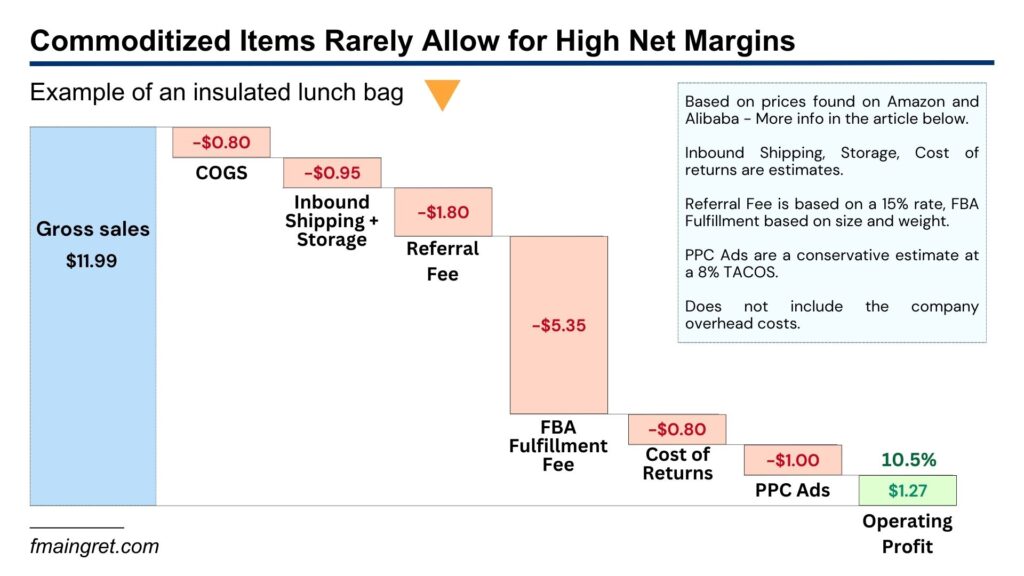

- There are extra costs involved, such as shipping the items to the US, and storing them.

- His sales are slower than expected, so he started running PPC ads to increase them and get more reviews.

- These damn customers are never satisfied, and some return the items. He estimates that this is costing him about $0.80 per item on average.

After accounting for these expenses, his operating profit is actually 33%, or $6.67 per unit sold. That is less than expected, but still enough to pay his bills and to fund his business expansion.

However, after selling his lunch bags for a while, Joe noticed that his sales suddenly dropped. This is when he realized that another seller created a listing with a very similar item, at a much lower price:

How could they list at $11.99 while his price is much higher? He doesn’t understand how this seller could make a profit, until he realizes where the company is located.

Joe is actually competing with a seller based in China. It isn’t clear if this is his supplier or a middleman based in China, but they can afford to lower prices and/or to run on much lower margins. Our seller Joe decides to cut his price to be competitive, and reduce his PPC expenses to still generate a profit, even if it slows down his sales.

Or as a waterfall chart:

Even with these lower prices, sales keep dropping. Sure, Amazon is saturated with hundreds of types of lunch bags. But there is another reason: Temu. Joe quickly finds out that the same bag is listed for $3.99 on the Chinese website. There is no way he can compete; $3.99 is less than his shipping costs alone. He hopes to quickly get rid of his inventory and will discontinue this product from his Amazon store.

This story isn’t unique. It is very easy to find thousands and thousands of products that were once doing well on Amazon, but that saw drastic price cuts and decreased sales over the past couple of years. Manufacturers integrating forward and cutting the middleman reshaped the market in a way that many US sellers should rethink their business model.

Is Private Labeling Dead?

To summarize the two sections above, my two main issues with this model involving selling undifferentiated product is that:

1 – The barriers to entry are so low that the market can quickly get saturated. From there, it becomes a race to the bottom.

2 – The manufacturer can release the same items, making it impossible for middlemen to compete

Now there are two points that people promoting this model always mention.

“Items can be branded; you need to build a brand and loyal customer will buy”

Creating a brand with an undifferentiated product takes a lot of time, money, and effort. Slapping a cool logo on product packaging isn’t enough, and investing heavily in social media and ad campaigns off Amazon takes considerable effort. Not that it can’t be done, but this is very risky.

“This is normal business; you’re supposed to always be looking for new products to sell”

Not only is this very time-consuming and exhausting, it is also more and more difficult. More and more niches are getting saturated, and the ones remaining are smaller. And even if you find one, it doesn’t take very long before thousands of new competitors notice and start selling the same product (privately labeled products require little product development time and can be launched very quickly).

Another issue is that you have to buy large quantities to benefit from economies of scale. And the more units you buy, the riskier it becomes. Following this model, it is easy to end up with thousands of unsellable units (or units that must be sold at a loss).

To be fair, I think private labeling items from Alibaba can work in some specific cases. Strong brands can quickly source products to enhance their product range. If a brand sells unique fitness supplements and creates a strong community of customers, they can, for example, source resistance bands in China and add them to their website (or use them as a gift to reward the most loyal customers). Or for brands that can ensure the supplier doesn’t work with anyone (hard to find on Alibaba).

Conclusion

I understand why some people are pushing this model. After all, it worked well for many people in the past, is easy to understand, and makes sense to aspiring entrepreneurs. It is easy to focus on the success stories, and ignore the thousands of people who failed due to an overly saturated market. A company selling market research software has a strong incentive to teach people about Alibaba. Again, I think their content is good quality and they are knowledgeable. I just believe people considering doing this must understand the state of the market in 2024, and the risks involved. Amazon in 2024 is very different from Amazon in 2016, and entrepreneurs should adapt their strategy to this new environment.