Back in December, several Linkedin posts caught my eye: these were about Zulily laying off part of their workforce, updates by former employees. I have heard of the company and knew it was a significant player in the ecommerce space, but I did not know they were going through a rough time. My initial thought was that they were merely downsizing, like many other tech companies over the last couple of months.

It was a few days after Christmas that I read the news about the company shutting down. Why would such a company close their doors? A company shutting down is always a complex issue, but in Zulily’s case, I can see that part of the problem comes from the evolution of the ecommerce landscape in the last few years, and customers’ expectations. As Sergey Podlazav, a former employee, put it: “It’s not one event that led to the fall of the company, it had to be a series of events.” Let’s try to figure out what happened to that company.

Zulily’s History and Business Model

Before we start, who is Zulily? Zulily is an American ecommerce company based in Seattle, and was established in 2009 by Mark Vadon and Darrell Cavens, former executives at Blue Nile. The company specialized in brand-name goods, and targeted mostly young mothers. Unlike traditional retailers, Zulily held no inventory, and chose instead to consolidate vendor-owned merchandise at its fulfillment centers or dropship directly to customers. Each day, Zulily offered different discounts, with sales typically lasting 72 hours. These discounts were an important part of their strategy, coupled with aggressive online advertising.

Zulily went live on January 27, 2010, initially focusing on children’s apparel. In less than a year, it had become a cash-flow positive business. The company went public in November 2013, with 2.6 million active customers and $331 million in revenue, valued at $2.6 billion. At this time, everything is going relatively well for the company, but growth begins to slow down. In August 2015, Liberty Interactive’s QVC division acquired Zulily for $2.4 billion.

Zulily’s business model initially relied heavily on flash sales, but in 2015, the company reduced these in response to customer feedback. Retaining customers was challenging, and despite an increase in revenue in early 2015, the growth was slower than in previous quarters. Zulily began holding some inventory in warehouses to shorten delivery times, but faced quality control issues, including defective and incorrect products.

By 2023, things went south for Zulily. Following a notable decline in revenue in 2022 and 2023, Qurate Retail sold Zulily to Regent, L.P. in May 2023. The company faced multiple layoffs and downsized its headquarters. In December 2023, Zulily laid off over 800 employees and announced a going out of business sale.

Why Did Zulily Fail?

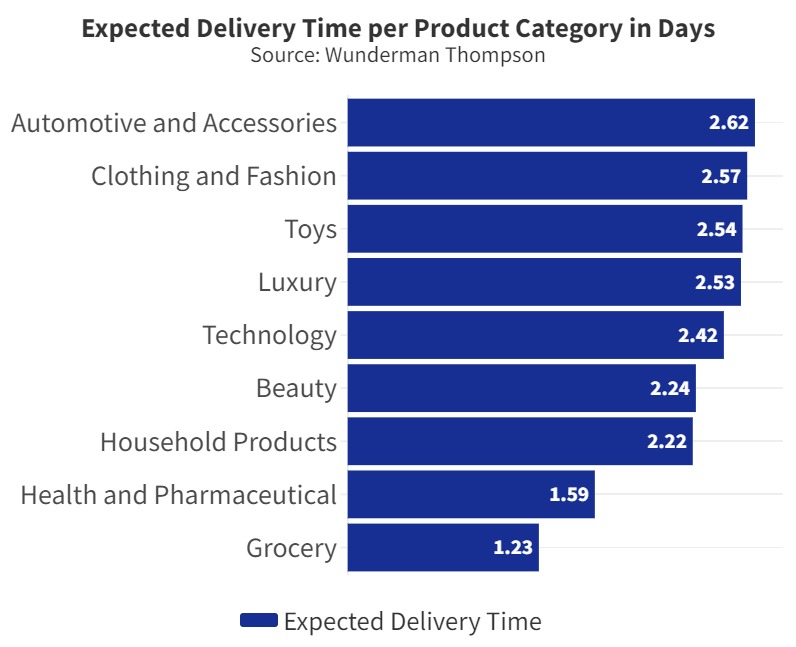

If you’ve been in the industry for more than a few years, you know how fast companies can innovate and customers’ expectations can change. Amazon significantly raised the bar for fast and free shipping. In 2023, waiting more than three days to receive their orders is unacceptable for many customers.

The limitations of dropshipping did not help, as this model often lengthens delivery times, compared with traditional retail. When reading reviews on the company on TrustPilot, one of the most frequent complaints is slow shipping. Some customers report several weeks before receiving their orders. If I made an impulse buy after seeing an ad for a flash sale, and had to wait 3 weeks to receive it, I wouldn’t even remember what I ordered in the first place.

Zulily understood that they needed to get the products to the customers faster, and stored inventory in their warehouses. Unfortunately, other issues appeared and things did not improve fast enough. In a 2020 eMarketer study, free and fast shipping was the main reason customers bought from Amazon (79% of customers said it was important), trumping product selection (68%) or pricing (49%).

It’s not all about fast shipping: the cost of shipping and returns also matters. For a long time, Zulily’s shipping policy was another puzzle. Customers faced a somewhat convoluted system where the first order of the day incurred a shipping fee, but subsequent orders shipped free. This strategy intended to encourage multiple daily purchases, but I’d be surprised if many customers saw this offer as valuable.

Zulily’s model was to offer frequent flash sales and advertise aggressively. However, this causes a few issues. The cost of advertising across all platforms has increased on the most relevant media for Zulily’s, decreasing the return on investment. This is a problem, because the company heavily relied on these ads and struggled with retaining existing customers. I believe a low customer retention rate is a profitability killer for many companies.

I’m not saying flash sales are necessarily a bad thing. Flash sales create a sense of urgency and exclusivity, encouraging quick purchases. It initially attracts customers looking for deals and helps clear inventory quickly, reducing holding costs. However, Zulily struggled to maintain long-term loyalty. Customers were often inundated with too many deals, which caused decision fatigue. Additionally, the revenue growth slowed as the novelty of flash sales wore off, and the business model became less effective in a market where consumers valued consistent availability, faster shipping, and a broad product range. Loyalty was most likely higher on a platform like Amazon, where product discovery was easier, and availability was constant.

An Unfavorable Business Environment

The ecommerce environment became a lot more competitive in the last few years. As we saw in the section above, innovation created new customer expectations, which drove even more innovation from existing companies. The market became tough, and strategies that worked in 2015 did not work anymore in 2023.

As dropshipping became more well-known, the market became saturated with dropshippers. This increased competition made it more difficult to find unique products and maintain profit margins, as many companies were selling similar or identical items. Barriers to entry were relatively low, and margins kept getting lower for dropshippers. Customers also became better at comparing prices and finding what they need at the best prices, thanks to new technologies.

Delivery times were of course an issue, and the COVID-19 pandemic strongly disrupted supply chains. These disruptions impacted the reliability and efficiency of dropshipping, resulting in lower customer retention rates. Now, dropshipping popularity peaked recently, well before Zulily decline, but in my opinion this only accelerated the decrease in revenues.

Conclusion

Zulily’s decline is a very complex issue, but we went over some of the factors that contributed to it. I found several articles dating from 2015 about the acquisition of Zulily by Liberty highlighting some of the challenges the company had to deal with. With the fast paced ecommerce landscape, things did not improve for Zulily. The high customer expectations for fast and free shipping challenged Zulily’s business model. Their reliance on flash sales and aggressive advertising initially attracted customers but struggled with long-term loyalty and profitability due to high advertising costs and low customer retention rates. The competitive ecommerce environment and changing market dynamics, including the impact of COVID-19 on supply chains, seem to have impacted Zulily’s operations. The end result was layoffs, and eventually the company going out of business.

https://news.yahoo.com/rise-fall-zulily-happened-seattle-194112357.html