I’ve made many questionable investment decisions over the years, but buying Walmart stock is not one of them. Don’t worry, I’m not here to give personal finance advice, but rather to talk about the retail giant and how it compares to the current king of ecommerce, Amazon.

For many years, Amazon has dominated the ecommerce world, performing much better than all of its competitors. But 2024 was different: Walmart is no longer flying under the radar and is getting more attention from marketers. But how big is it really?

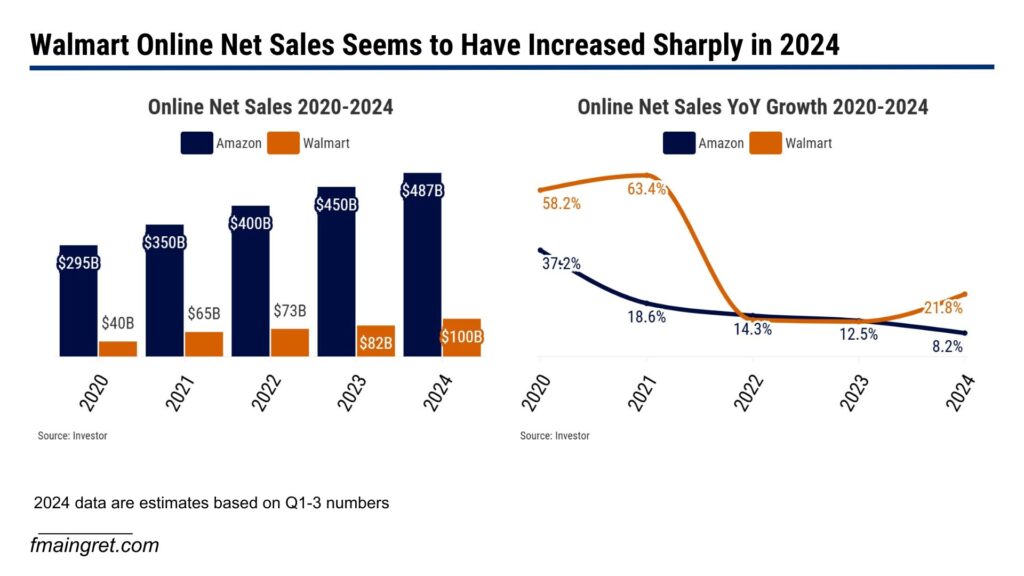

Looking at sales, Amazon is still miles ahead. However, its growth seems to be slowing down, while Walmart’s sales sharply increased in 2024 (up over 21% compared to Amazon’s 8.2% growth) and are estimated to reach $100B.

How can we explain Walmart’s sales growing at more than double the pace of Amazon’s, especially considering the two giants experienced similar growth in 2022 and 2023?

First, Walmart has greatly improved its logistics by using its extensive store network to offer services like curbside pickup and same-day delivery. Its marketplace has also grown significantly, as the company attracts a large number of third-party sellers, many of whom are already selling on Amazon. Walmart+ is seeing increasing subscriptions, though its penetration rate is just over 30%, compared to over 70% for Amazon Prime. Finally, Walmart has invested heavily in new technologies and strategic partnerships (for example, with Unity to create immersive shopping experiences—though I’m skeptical about the impact of these features) and uses its dominance in key categories like groceries to grow its online sales.

On the other hand, Amazon has made some interesting moves as well. For example, Haul is Amazon’s way to compete with Temu by selling low-priced goods shipped directly from China. Amazon has also invested in new advertising opportunities and developed AI features to improve the shopping experience.

For shoppers, Walmart’s new developments resulted in new shopping opportunities. 90% of Americans live within 10 miles of a Walmart store, and BOPIS (Buy Online, Pickup In Store) could help Walmart attract new customers. As for Amazon, time will tell if Haul is just an experiment or the start of something bigger.

For 3rd party sellers, Walmart is an interesting opportunity to generate additional revenues. The platform isn’t as complex as Amazons but attracts a significant amount of traffic. WFS (Walmart Fulfilment Services) is a strong alternative to Amazon FBA. Fees are similar (and sometimes even lower on Walmart, for example on larger items), and the platform is easy to navigate. However, Walmart marketplace recently became very competitive, with an influx of sellers based in Asia.

Overall, I think Walmart did the right thing to grow their online sales, and I expect then to grow again in 2025. On the other hand, I am a little underwhelmed by what Amazon did, although Amazon Haul is interesting. 2025 will be an interesting year, and I expect to see tough competition between marketplaces, just like competition between 3P sellers became tough post-covid.