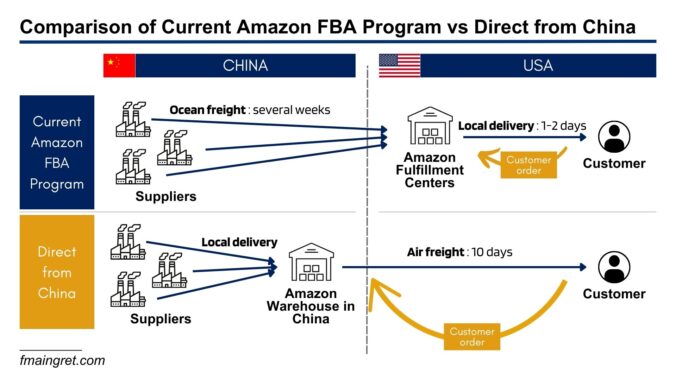

Right before taking a vacation, I saw the news about Amazon planning to assist sellers based in China to ship directly to US customers, similar to what Temu does. While I recognized the importance of this move, the news didn’t surprise me. It’s been clear that China-based sellers have become a key part of Amazon’s strategy. We’ve seen several moves in the past to help Amazon compete with Temu and Shein, so this isn’t entirely new.

However, this might be Amazon’s boldest move to date. My initial thought was, “Some Amazon sellers are in big trouble.” After discussing this shift, I’d like to reflect on the convergence between Amazon’s and Temu’s strategies and review the potential impact on US-based sellers.

Continue reading