Right before taking a vacation, I saw the news about Amazon planning to assist sellers based in China to ship directly to US customers, similar to what Temu does. While I recognized the importance of this move, the news didn’t surprise me. It’s been clear that China-based sellers have become a key part of Amazon’s strategy. We’ve seen several moves in the past to help Amazon compete with Temu and Shein, so this isn’t entirely new.

However, this might be Amazon’s boldest move to date. My initial thought was, “Some Amazon sellers are in big trouble.” After discussing this shift, I’d like to reflect on the convergence between Amazon’s and Temu’s strategies and review the potential impact on US-based sellers.

Amazon Plans to Facilitate Items Shipped Directly From China

CNBC reported that Amazon hosted an invite-only call with sellers in China to discuss these plans. The idea is that Amazon will help China-based sellers ship products directly from China to customers in the US, focusing on low-priced fashion and lifestyle items.

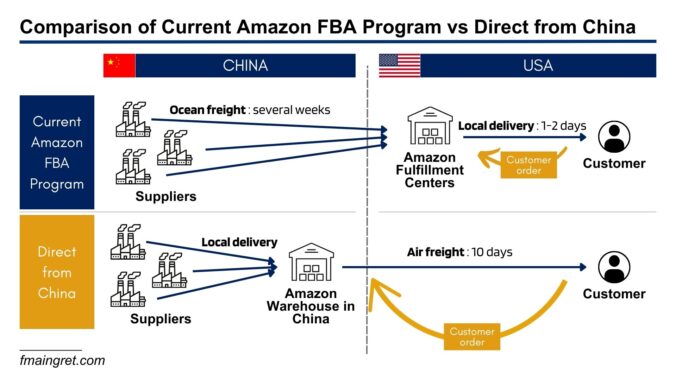

Unlike Amazon’s current model where sellers store their items at Amazon fulfillment centers, the items will be stored in Chinese warehouses and shipped directly from China via air freight. As a result, customers won’t receive items from China within 24 to 48 hours but within 9 to 11 days, according to Amazon. Amazon would take advantage of the de minimis rule that helps Temu save on duty and some taxes. We all hate waiting for our packages, but sometimes we don’t mind compromising if we get deep discounts. That’s exactly what makes Temu successful and what Amazon attempts to replicate.

It’s still unclear when this program will start, but I assume it won’t take very long. The competition is tough between Amazon and Temu, and both are adapting their strategies. Interestingly, Amazon is taking inspiration from Temu, while Temu imitates some aspects of Amazon’s strategy.

The Convergence Between Temu and Amazon’s Strategies

Before analyzing Amazon’s and Temu’s strategies, let’s look at the advantages and drawbacks of each model.

The first advantage of having local fulfillment centers is shipping speed. One of Amazon’s greatest strengths is their ability to offer free next-day delivery to millions of Prime customers. While customers are sometimes willing to wait longer if they can get lower prices, longer delivery times when ordering directly from China can cause frustration and a poorer customer experience.

Shipping from China gives manufacturers more flexibility in their productions, allows them to do more testing via small batches, and potentially offer a wider range of products. This also facilitates inventory management, as sellers don’t have to ship large quantities of inventory overseas.

Finally, basing a business model on exporting from China and taking advantage of the de minimis rule exposes the company to risks if regulators decide to take action. While nothing has happened yet in the US, there are discussions about it, and the European Union is working on a proposal to impose import duties on cheap goods bought online.

Now it’s clear that Chinese sellers are an important part of Amazon’s strategy. The marketplace has seen an additional 20% increase in Chinese sellers joining in 2023, and the number of Chinese sellers exceeding $10M/year in sales increased by 30%. Recently, Amazon also slashed selling fees on clothing items priced below 20%, attempting to compete with Shein and attract more Chinese sellers. It’s no surprise to me that they may now facilitate the sale and shipping directly from China. This offers lower prices to their customers while giving third-party sellers more flexibility.

On the other hand, Temu may fear new regulations that would significantly increase their costs, such as the elimination of the de minimis rule. Temu also understands that delivery speed is more important than pricing for a significant part of US customers. Temu has already begun shipping some orders from US warehouses, a shift from 0% just a year ago. According to Marketplacepulse, 102 out of 120 recommended products on Temu’s homepage ship from the US and arrive in less than 5 days. This shows how much their priorities are changing and helps them compete effectively with Amazon’s extremely efficient supply chain.

Personally, I find that diluting each company’s value proposition will create a confusing experience for consumers. The marketplace model is great, but we’re now starting to see the same product assortment on every platform, from Amazon to eBay, including Walmart or TikTok Shops. On the other hand, many customers would love to experience low prices and fast shipping by cutting out the middlemen. There are millions of middlemen currently selling on Amazon. So how can this strategy shift impact them?

How This Could Impact US-Based Sellers

It’s hard to predict how many sellers will opt for this program. However, some potential consequences of this move are obvious:

- A larger number of China-based sellers joining the platform

- Lower prices across strategic categories such as clothing or lifestyle

- A lot more listings in these categories

- Wider discrepancies in delivery times

In my opinion, every Amazon seller will experience the impact of this program, but to varying extents. Amazon seems to focus on certain categories like fashion or lifestyle, so sellers in these areas will likely feel a stronger effect compared to others.

When it comes to types of sellers, I believe big-name brands will be the least affected. Many of them sell directly to Amazon rather than through the marketplace and have a major asset: brand equity. They generate significant traffic through branded search, and many customers are loyal to the brand and its perceived quality. Customers are also less price-sensitive. Similarly, wholesalers selling brand-name items should experience minimal disruption.

On the other hand, private label sellers will take the biggest hit if this program becomes popular. They will face more competition, likely lower prices across categories, and potentially increased costs for acquiring traffic. Business has already been challenging for these sellers since their own suppliers started selling on Amazon, and I believe it will only get tougher from here.

Somewhere in the middle are brands with unique items but lacking brand recognition. I believe these sellers should be fine as long as their product cannot be easily replicated. Getting traffic and launching products may be initially harder, but things should improve in the long run.

Finally, the difference in delivery times between the two models can be relevant in some industries. Brands selling products that customers buy impulsively and need right away should be less concerned than those selling items customers don’t mind waiting 10 days for.

Conclusion

Amazon’s move to facilitate direct shipping from China represents a major strategic shift to compete more effectively with Temu. Amazon and Temu are battling for market share, trying to meet customers’ needs in terms of pricing and delivery speed. Having products locally available is a key part of Temu’s strategy, while Amazon is deploying more features to attract China-based sellers and lower prices.

For US-based sellers, the impact of this program will vary. Established big-name brands should experience minimal disruption, while the millions of private label sellers may face intensified competition, pricing pressures, and potential impacts on profitability and customer acquisition costs.

Ultimately, customer behavior will drive both Temu’s and Amazon’s strategies, but regulatory changes could potentially affect the direct-from-China model. Amazon is taking a risk here, and we’ll have to see if it pays off.

https://gizmodo.com/amazon-temu-shein-shopping-china-direct-shipping-1851562838

https://www.marketplacepulse.com/articles/amazon-and-temu-swap-strategies

https://www.cnbc.com/2024/06/26/amazon-plans-discount-store-in-bid-to-fend-off-temu-and-shein.html