When Amazon initially announced their new fee structures for 2024, sellers were expecting to see an increase in how much they’d pay. But now that the fees are implemented, there is a lot of outcry across Amazon seller forums, Reddit, LinkedIn, and social media. The object of all this rage: Amazon’s new inventory placement fees. Beyond the Change.org petition to get this fee removed, this made so much noise that the FTC is now investigating it. The agency’s interest followed Fortune’s recent article on how sellers feel about this new fee.

Today, I want us to review what this fee is, explain why sellers are furious and how it may impact your business. Finally, we will see if every company is impacted equally and investigate potential strategies to mitigate the impact of this fee.

What is this new inventory placement fee?

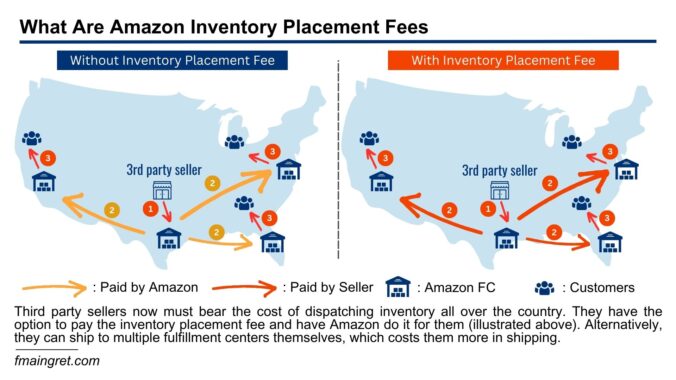

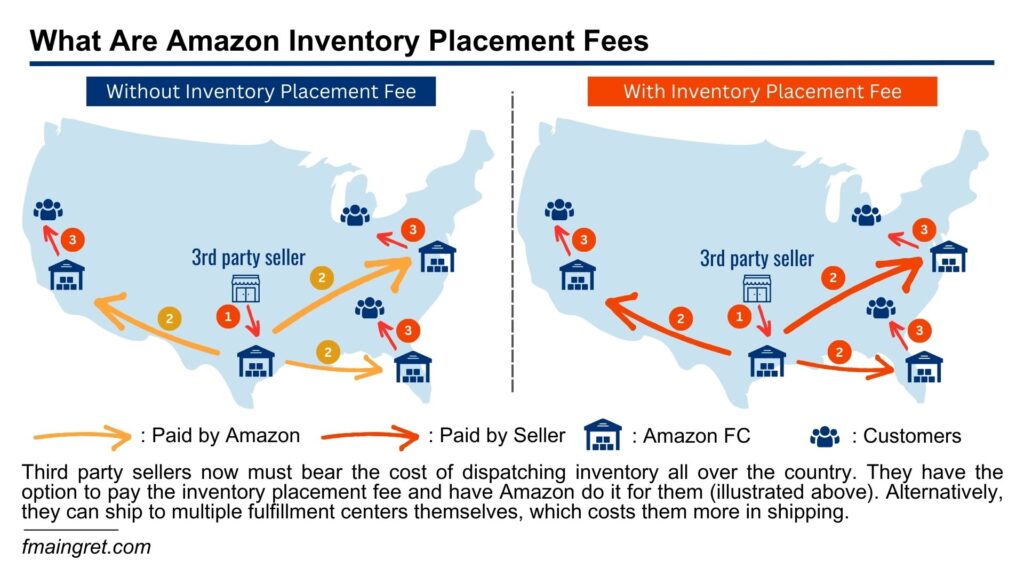

When shopping online, customers hate waiting for their packages. That is why Amazon’s Prime membership is so popular, people love receiving their order within a day of placing them. Despite the lightning-fast delivery, Amazon doesn’t resort to costly air shipping. Instead, they leverage their expansive network of fulfillment centers (FC) strategically positioned all over the United States. If a customer located in New York City orders shoes from Amazon, the item is more likely to come out of an FC located in the northeast, rather than from one in California. By using their large network, Amazon optimizes efficiency and minimizes delivery times, improving the overall customer experience.

In order to have inventory available for shipping all over the country, Amazon typically distributes inventory to multiple FCs. Third-party sellers used to ship their items to mostly one local FC and have Amazon dispatch the inventory for them. Amazon has now changed its approach and requires sellers to ship inventory to multiple FCs located throughout the United States. If they don’t, sellers have the option to ship to only one FC, but have to pay the dreaded inventory placement fee.

Why Are Third Party Sellers Furious?

Shortly after Fortune’s article was published, the FTC initiated contact with Amazon sellers to learn more about the impact of the fees, according to multiple sources. And I believe they have not heard great things about this new fee.

The main reason why third-party sellers are upset is not the added complexity to the inbound shipping processes, it is clearly the fees. The YouTube channel E-BusinessOnline (Link below, great content I recommend) gives us a great example of how much sellers can expect to pay. Sellers are presented with three options:

- Ship to multiple FCs (Optimal Split)

- Ship to a limited number of FC (Partial Split) for reduced fees

- Ship only one FC (Minimal Split) but pay the full fee

As you can see in this example (and I noticed amounts in the same magnitude when shipping inventory), this is quite a difference compared to when sellers only had to ship to one destination.

Mira Dix, Amazon Spokesperson, told Fortune that “the new fee changes allow sellers to choose where they want to have Amazon take on different aspects of fulfillment and where they want to do the work themselves. On average, the 2024 fee changes are significantly less than those announced by other major fulfillment services, and many sellers will see a decrease in the average fees paid to Amazon per unit sold.”

However, sellers are expecting an overall increase in fees, not a decrease. There are numerous testimonials online on how specifically the inventory placement fee will kill many sellers already thin margins.

User Jigglypuffsx on Amazon seller forums reported: “Bro, they are going crazy. It used to cost me $150 for 2 pallets to ship to Amazon warehouse. Now it will cost around 1k for the same products, nonsense fees. It will not help anybody on long term Amazon or 3rd party seller”

User LVSeller123 talks about the alternative to ship to multiple FCs instead “Yes you can avoid the placement fee this way but the bigger issue is they increased LTL Partner Freight price by 600%. Last week a shipment cost me $600 for 4 pallets. This week that exact same shipment WITHOUT placement fee is $2100. They want me to split it into 5 warehouses. Absurd.”

Is Everyone Equally Impacted by the Fees? And What Could be Done to Reduce Them?

After reading a few dozen testimonials and complaints, it is clear that some sellers are hit harder than others. Sellers shipping smaller volumes of inventory to Amazon tend to me more impacted, as it seems that these fees are higher for small parcels than for LTL shipments.

Another user of Amazon seller forum reports “Just had our first today. Was a 750 small item shipment, about $40 to ship. They forced us to pay an additional $135 on top to redistribute these shipments, the no fee option was grayed out. May be changing our FBA strategy going further if this is the new normal.” It appears that the Amazon optimal shipment split or Partial shipment splits is not available for shipments that are too small.

It could be a question of shipper cases rather than units sent. Amazon may break cases when shipped to one FC and allocate them, but they only allow sellers to ship full cases to FCs. This means, for those shipping a few cases with a lot of units, they will have to pay the highest cost per unit. It is still early to tell, but shipping more inventory less frequently, alongside using smaller shipper cases for small items so the optimal/partial splits options are available, could be a way to reduce these fees. Geographic location could have an impact as well, but there isn’t enough evidence to plan around it for now.

Some Amazon forum users also reported that Chinese third-party sellers, operating directly from China, are not subject to these fees. While there is a theory that Amazon favors Chinese sellers, potentially as a way to counter competitors Temu or Shein, it remains speculative until there is enough evidence to support it.

In this case, it appears that sellers operating from overseas and using the Amazon Global Logistics (AGL) program have access to Amazon Managed Placement, allowing them to bypass the inventory placement fee and save on inbound logistics.

A way to avoid these fees highlighted in Fortune’s article is to use a program called AWD, for Amazon Warehousing and Distribution. This program is designed to let sellers store their long-term inventory into Amazon’s warehouses before they are shipped to fulfillment centers. However, this also means giving Amazon more power over businesses supply chains, who then need to pay the fees and costs associated with AWD.

Finally, some sellers report having found loopholes and glitches in the inbound shipment creation process that can be exploited to avoid paying these fees. Not having tried myself and not having more information than individual claims, I can not elaborate on these.

Conclusion

When I first heard about the new FBA fee structure, I found that the main issue was its complexity. Instead of increasing fulfillment fees per item, Amazon decided to decrease them but add additional fees, such as this new inventory placement fee, but also fees that punish sellers for not having enough inventory such as the low inventory fee. In addition, there are fees waivers for those who use specific Amazon programs, like Amazon Global Logistics or Amazon Warehousing and Distribution.

Now that sellers are experiencing the costs associated with the new fees, they are pushing back. But this could be the beginning, as it is still difficult to measure the impact of the low inventory fee that will be applied later this year. While this is very complex, I encourage Amazon sellers to research and weigh their options. The more complex the system is, the bigger the competitive advantage will be for those who understand it.

https://www.youtube.com/watch?v=JWFAdDSEm_Y

https://fortune.com/2024/03/01/amazon-inbound-placement-low-inventory-seller-fees/

https://sellercentral.amazon.com/seller-forums/discussions/t/32b34074548ddc40dc72a1c1a3f289ea

https://sellercentral.amazon.com/seller-forums/discussions/t/af8d6779-9354-4688-90d8-2d10fe5a4db2