Benjamin Franklin may have said, “In this world, nothing is certain except death, taxes, and supply chain nightmares before the holidays.” And I’d agree with him. To be fair, the marketplace has become so competitive and complex that large variations in volumes are bound to create some troubles. However, it seems like this year has been especially challenging for those selling through Amazon FBA.

Should we blame the port strike earlier this year, larger volumes of inventory being shipped, or other factors? In today’s article, I’d like to go over what happened with Amazon and see how the company is dealing with it. We’ll then look at how sellers were impacted, but more importantly, why fixing these issues is critical for the ecommerce titan.

Amazon is Experiencing Bottlenecks During BFCM

Like every year, the holidays are a huge opportunity for sellers to generate revenue—not only because of BFCM or other sales events but also because of Christmas. This is especially true for those with seasonal businesses, such as holiday cards or toys. And as expected, sellers using FBA will want to ensure their product does not run out of stock during this period. This creates a lot more traffic across the supply chain and causes issues every year.

This time, some sources reported longer receiving times at some of Amazon’s West Coast inbound locations. According to an MSN article, “These inbound facilities have likely experienced backlog due to an onslaught of cargo flowing in throughout major West Coast ports in summer 2024 as more retailers like Amazon pulled goods forward ahead of the Oct. 1 East and Gulf Coast port strike.” As a result, Amazon lowered the inbound placement fees for shipments to the East by 5 cents per unit to encourage more sellers to ship their inventory away from the clogged western fulfillment centers.

However, I have seen several reports of major delays in the central and eastern parts of the country as well. Outside of the US, there are incidents in other countries where FBA is a thing. For example, in Germany, Amazon has stopped accepting deliveries from DHL for now. As a result, DHL is sending affected shipments back to sellers.

Amazon took some preemptive measures and warned sellers well in advance to send their inventory in August and September to be ready for the holiday season. So should we blame sellers who saw their product go out of stock during this critical time of year?

The Impact on Third-Party Sellers

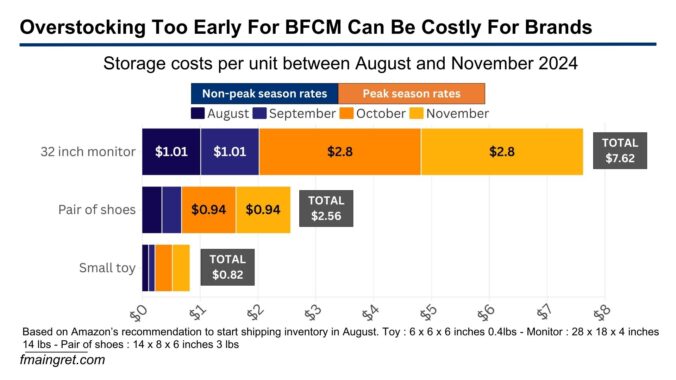

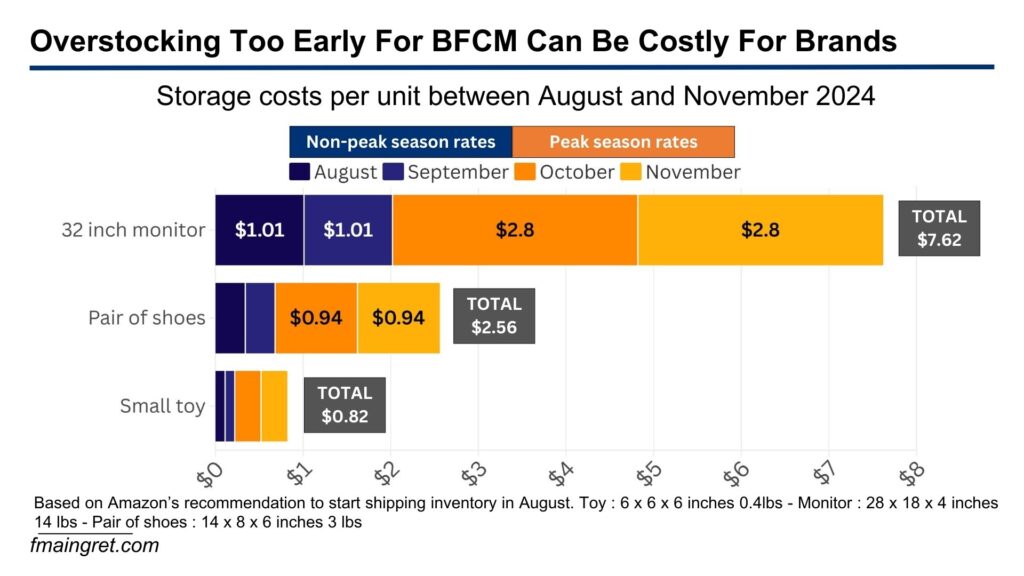

It is obvious why any shortage would negatively impact sellers. But planning for these events is also very costly, especially based on Amazon’s terms and guidelines. Sending inventory in August, as recommended by Amazon, involves placing large orders of inventory well before the holiday season, impacting businesses’ cash flow.

Once sellers have received and sent inventory to Amazon, they need to ensure their storage limits allow them to stock enough inventory for the season. Even if that is an option, storage costs are a significant expense, especially with Amazon increasing fees. Even with Amazon reducing inbound placement fees for shipments to the East by 5 cents per unit, many sellers feel that is not enough—especially knowing that the situation in the eastern region isn’t great either.

In the end, we are stuck with sellers choosing to either miss out on sales by running out of stock or spending extra to try to have their product in stock, sometimes without guarantee. This is causing a lot of frustration. I can only imagine what it’s like to be a seller in Germany and have DHL return an inbound shipment. But should we expect Amazon to make these inbound issues a priority?

Is This Issue a Priority for Amazon to Fix?

The period around Black Friday/Cyber Monday and Christmas is the Super Bowl of ecommerce, and a lot of the sales happen on Amazon. You would think Amazon would be incentivized to increase their capacity and supply chain capabilities for this period. They are proactive in their communications to sellers, giving them guidelines and discounts on inbound fees. On the other hand, increasing capabilities for just a few weeks a year is a significant investment for Amazon. Would the return on investment be sufficient to justify such a massive project?

Let’s remember that Amazon’s goal is to have products to sell to their customers. I like to divide their offerings into two categories: strong name brands that customers care about (Apple, Adidas…) and commoditized/semi-commoditized products that customers don’t care about branding (“Oh, I bought this off Amazon.”).

The first group of products is often managed through 1P, using different logistics processes. Brands have less to worry about, as Amazon orders directly from them. For the second group of products, the items are so similar they are almost interchangeable. If product ABC at $9.99 isn’t available due to supply chain issues, there is often a very good chance a very similar product XYZ will be available at $10.49. And if customers don’t care which one they buy, there is little difference for Amazon: they have made the sale and collected the fees.

I see one thing that would incentivize Amazon to do better: seller retention. The ecommerce world keeps becoming more competitive—not only with Walmart but also Shein, Temu, and TikTok trying to attract a wider variety of brands, as well as smaller marketplaces trying to gain an edge. If Amazon can’t give their third-party sellers a good reason to stay, they may leave and help the growth of other channels. As of today, Amazon is still the king, but things can change fast in ecommerce.

Conclusion

Amazon’s Black Friday and Cyber Monday bottlenecks truly are a challenge for third-party sellers. While Amazon took steps like offering discounts and advising sellers to send inventory early, third-party sellers were still heavily impacted. These issues force sellers to either invest to stay stocked or miss out on critical sales opportunities, creating frustration.

It is true that customers—Amazon’s priority—are not as impacted while doing Black Friday shopping. However, as ecommerce becomes more competitive with platforms like Walmart, TikTok, or Temu, Amazon must prioritize improving its logistics if it wants to retain third-party sellers.

https://ecommercenews.eu/amazon-experiencing-bottlenecks-in-logistics/