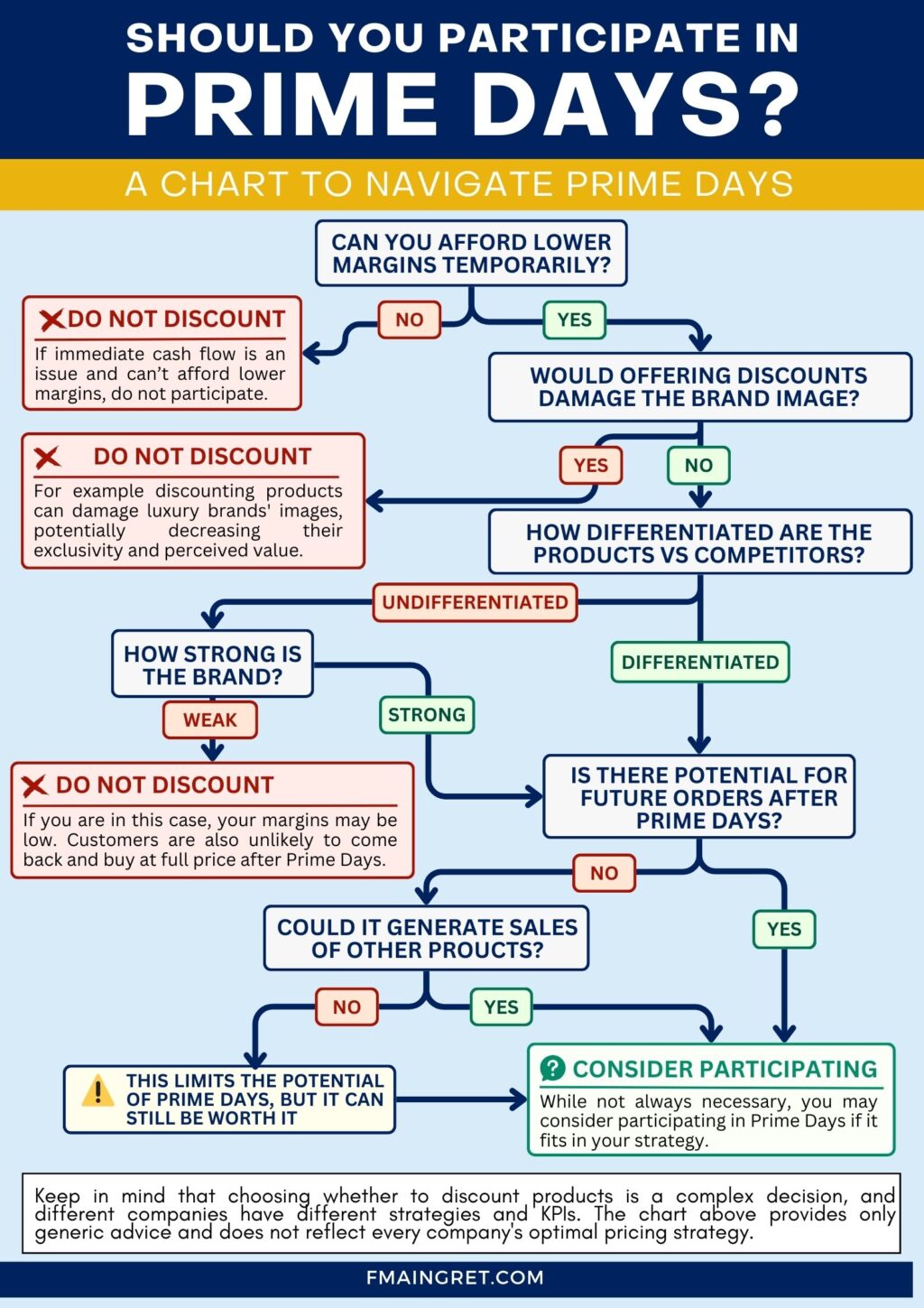

As we approach July, I bet your LinkedIn feed is packed with guides on how to prepare for Amazon Prime Days. “This is the biggest day of the year!” they say. “Make sure you have enough inventory” or “Here’s how to optimize your listings” they’ll advise. While there is often good advice in these posts, the authors assume you are participating in Prime Days. Many entrepreneurs selling on Amazon believe they MUST discount their products during these few days. But should they really?

In this post, I’ll argue that not every business benefits from participating in Prime Days. Low margins, product positioning, brand image, inventory issues—there are many factors impacting a business’s interest in flash sales. So, let’s explore when a business should NOT participate in this event.

Disclaimer: This assumes the business CAN afford to temporarily lower prices. If immediate cash flow is an issue, I recommend you address this before even considering discounting prices.

Would Offering Discounts Damage Your Brand Image?

Sometimes, brands should not discount their prices if doing so could damage their image. In some cases, customers may begin to perceive the brand as less exclusive or question the quality of the products. For example, if a brand like Gucci were to constantly have sales, it could kill its luxury image and make it seem more accessible, losing its appeal to high-end customers.

To a lesser extent, this applies to tech products. Heavily discounted prices compared to industry standard discounts might signal the product is technologically outdated compared to its competitors. The same goes for food products—customers might start doubting their freshness if discounts are too high. I wouldn’t buy 50% off chicken wings from the gas station, and I think many customers feel that way about online shopping.

Do You Have Enough Inventory?

If your inventory is limited, and you believe offering Prime Day discounts would cause your products to go out of stock, I recommend not participating in the event. Not only would the stock you have generate much less profit than it should, but being out of stock would also kill the product ranking against its competitors, especially if they discount theirs. In most situations, slower sales are preferable over being out of stock, and that is the case during Prime Days.

How Differentiated Are Your Products vs. Competitors?

In my opinion, this is the main issue brands face. If their products are commoditized (there is little differentiation besides pricing), the category can quickly become a race to the bottom. This is a huge problem year-round, but especially during Prime Days. In a commoditized category, packed with manufacturers and private label sellers (very common on Amazon in 2024), there will always be a competitor willing to undercut your offer. Is it really worth selling your products at a loss? If you’re in this situation, pay attention to how much customers value your brand.

How Strong is Your Brand?

Even if your product’s technical features are very similar to your competitors, a strong brand can give you a much better fighting chance. Your fans will buy at full price, but some customers might be waiting for a discount to try your brand for the first time. In that case, discounting can be a winning strategy. But for weaker brands (which is the case for many brands selling exclusively on Amazon), unloyal price-sensitive customers won’t care about buying from a competitor if they can get better pricing for a similar product elsewhere.

Do You See Potential for Future Orders at Full Price After Prime Days?

I’m thinking mostly of consumable products, such as skincare, household supplies, or sports nutrition products. If your product isn’t commoditized and/or your brand is strong enough, discounting the products (even at a loss) might help convert new-to-brand customers so they buy at full price later. It boils down to your customer journey (unfortunately difficult to track on Amazon) and reorder rates.

Now if you don’t think customers will ever reorder, this doesn’t necessarily mean you shouldn’t participate in Prime Days, but you might be leaving money on the table if you offer large discounts.

Could the Sale of Your Discounted Product Generate Sales of Other Products?

If customers won’t come back to buy the same product at full price, maybe they could be interested in buying other products from your brand? For example, if they buy your discounted protein supplements during Prime Days, maybe they’d buy your vitamins later at full price. If you don’t think this scenario is realistic for your business, maybe reconsider participating in Prime Days.

The Case of Participating as a Defensive Move

Some might argue that even with undifferentiated products, a weak brand, and no potential for future orders, sellers should participate in Prime Days as a “defensive move” to not lose market share to competitors. I am generally against this approach, as I see no benefit in temporarily increasing market share at a loss if there is no potential to make up for this loss later. Participating as a defensive move would only slow down the inevitable process of decreasing gross revenues, while accelerating the decline of net profits. Moreover, if customers only care about pricing, there is a deeper issue than Prime Days that needs to be addressed.

Conclusion

As you see, participating in Amazon Prime Days should not be automatic but is a complex decision involving multiple criteria. While the event offers great potential to see more traffic and increase gross revenues, not every seller may benefit equally. Maintaining brand image, managing inventory effectively, and considering product differentiation are critical factors. Strong brands with loyal customer bases may find Prime Day more advantageous for customer acquisition and future sales. However, for sellers with limited inventory or commoditized items and weak brand/product differentiation, participating could negatively impact long-term profitability without causing a significant increase in revenues.