When I moved to Texas from France, I was surprised to see this many dogs when walking around. I thought every other person had a dog. I wasn’t too far off: 66% of U.S. households (86.9 million homes) own a pet, with dogs being the most popular pet (65.1 million U.S. households own a dog).

As a result, the pet care market is huge, $246.66 billion worldwide in 2023 and is projected to grow to $259.37 billion in 2024. Of course, this market is very competitive, and even the largest companies have to constantly innovate to grow.

The e-commerce giant Chewy announced surprising plans to expand, and I’d like to discuss whether other retailers should emulate them.

Chewy’s Surprising Strategic Move

Despite reporting better-than-expected results in Q4 2023, Chewy’s sales dropped by 10% after the earnings call. Chewy is facing intense competition from other online retailers like Amazon, but also brick-and-mortar stores like Petco or Walmart.

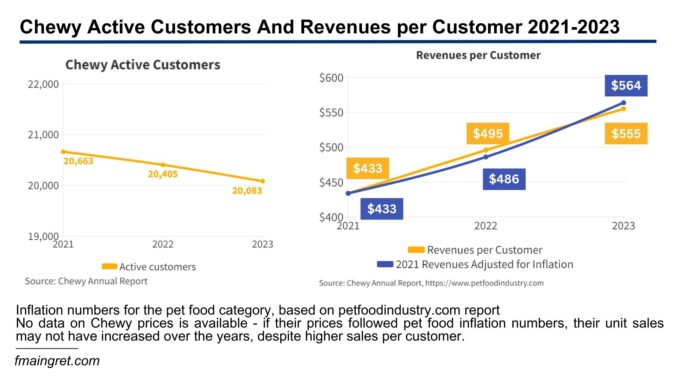

Another problem for Chewy is that the company saw a decline in their customer base, 1.6% less than last year at 20.2 million active customers. Now, the sales per customer have increased; the company generates about three-quarters of its sales from product subscriptions. This is, of course, an important part of the retailer’s strategy. The pet market tends to hold up well in difficult economic times (people still need to feed their pets and rarely compromise on how much they spend on their furbabies). However, other competitors also offer subscription services, including Amazon. Their “subscribe and save” program on thousands of items is popular, especially coupled with the lightning-fast Prime deliveries.

But Chewy has big plans to grow its revenues and announced venturing into veterinary care with its launch of Chewy Vet Health. The first location will be in South Florida, set to open early next year, with plans for more locations in 2024. These vet clinics will offer a range of services including routine check-ups, urgent care, and surgeries. “Chewy Vet Care is inspired and designed by a team of veterinary experts to combine personal, patient-centered medicine with the latest technology in an environment where customers will love to take their pets, and care teams will love to practice,” said Dr. Benjamin Carter, chief medical officer at Chewy Vet Care. “We are confident we can drive positive change by addressing critical pain points straining the veterinary industry, such as burnout and lack of flexibility, while providing the convenient, transparent, and trustworthy access to care that today’s discerning pet parents appreciate,” he continued.

The new veterinary practices will complement Chewy’s existing health services like pet pharmacy, tele-triage, and insurance plans. Mita Malhotra, president of Chewy Health, explained how the unique in-practice and post-visit experiences are tailored for both pet owners and care teams. Of course, this will be another way for Chewy to sell its products and get more people to subscribe to automatic deliveries.

How Will Opening Vet Clinics Help Chewy?

In the context of the strong inflation we’ve seen in the past few years and potentially weakening economic conditions, I think opening vet clinics addresses two issues Chewy is facing.

First, this will help them achieve higher net margins. Pet supplies, especially food, are relatively low-margin items, making any strategic mistake costly for the company.

Secondly, it may help the company get new customers, through upselling people visiting the vet clinic and selling them Chewy items, or even Autoship deliveries. Autoship deliveries have been a large part of Chewy’s sales over the years, and their subscription system is a key part of their value proposition. Customers appreciate the convenience, fast shipping, but also the company’s transparency.

It appears that Chewy has been losing active customers year after year. Their revenues per customer increased significantly between 2021 and 2023, from $433 per customer to $555. However, inflation for pet food was in the double digits from 2021 to 2022 and 2022 to 2023. It isn’t clear how sales increased in volumes: did Chewy sell more products, or did they sell the same quantities at higher prices? The point is, this new initiative may contribute to both increasing sales per customer and increasing the number of active customers. The share of customers enrolled in Autoship increased over the last few years, and the number of active customers decreased, suggesting that Chewy struggled to attract new customers. Adding a new way to address new customers may help diversify their customer base.

Finally, this new initiative could give them more credibility in the pet supplies market and help them justify higher prices than some of its competitors. By employing qualified and experienced veterinary professionals and meeting the high standards of the veterinary care industry, Chewy Vet Health clinics can demonstrate expertise, professionalism, and a commitment to quality. Chewy Vet Health clinics can deliver personalized care tailored to the unique needs of each pet and their owner.

Ultimately, this is an opportunity for the company to build a stronger brand, increase its net margins while getting new-to-brand customers.

However, the execution of this strategy will be key to its success. We shouldn’t forget that Chewy is operating in a very competitive industry. Operating veterinary clinics involves working with very complex regulations, licensing requirements, and compliance with veterinary medical standards and practices. Not only is meeting these criteria costly, customers have very high expectations. Vet care is expensive, and customers see their pets as family members. Finally, offering the optimal omnichannel experience, and maintaining the right brand image will be another major challenge for Chewy.

Conclusion

Chewy’s decision to expand into veterinary care with the launch of Chewy Vet Health clinics seems to be a strategic move aimed to address its declining customer base and relatively low margins.

By integrating veterinary services with their existing offerings, Chewy can potentially increase net margins, attract new customers, and build a stronger brand through increased credibility and personalized care.

However, considering how complex operating veterinary clinics is, and how high customers’ expectations are, this will be a major challenge for the online retailer. I believe there is potential, and I am curious to see how this will turn out.