Are we about to see department stores return to their former glory, or are they a relic of the past? Only time will tell. However, reading business news makes me a little pessimistic about their future. Maybe I missed something big here, but the latest news on JCPenney led me to think the company won’t make a comeback anytime soon.

The Merger and What it Means for JCPenney

In case you missed it, JCPenney and SPARC Group have created a new organization named Catalyst Brands, combining SPARC’s five apparel brands (Aéropostale, Brooks Brothers, Eddie Bauer, Lucky Brand, and Nautica) with JCPenney’s operations and private labels. The two companies bring together $9 billion in revenue, across a total of 1,800 stores and 60,000 employees. The plan for Catalyst Brands seems to be generating economies of scale, sharing customer data and distribution networks to improve efficiency, cross-sell products, and offer a better shopping experience, for example, with unified loyalty programs and credit cards.

Catalyst Brands will be able to reduce costs through improved efficiency. The company will have more data to create more personalized and efficient marketing campaigns or cross-sell products. However, I am skeptical about how this merger will address department stores’ current challenges.

Current Issues with Department Stores

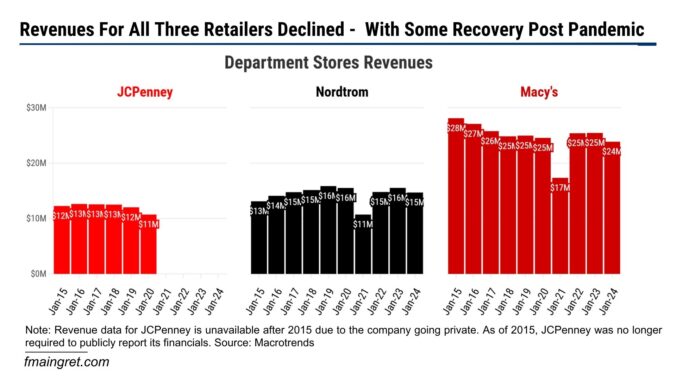

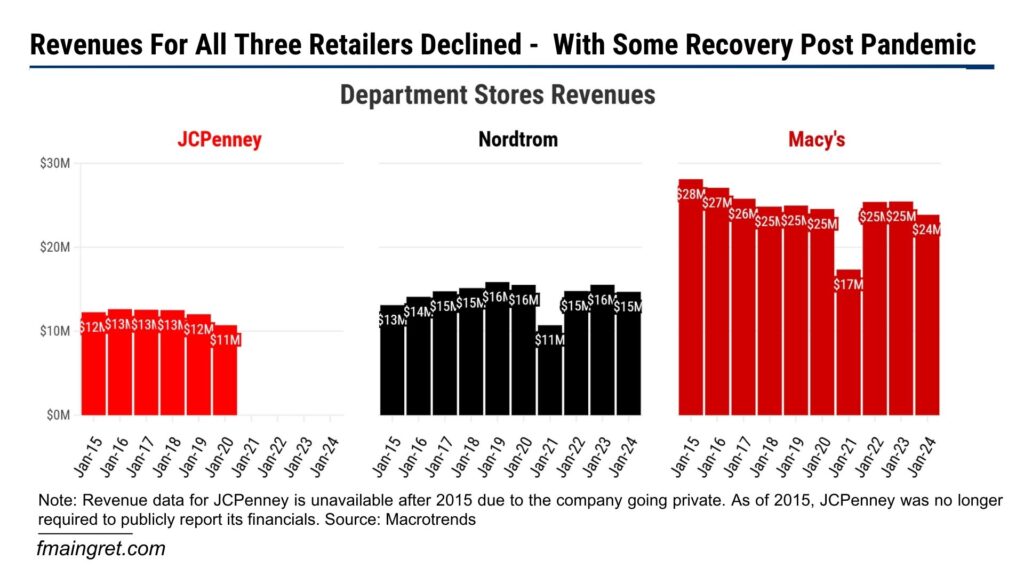

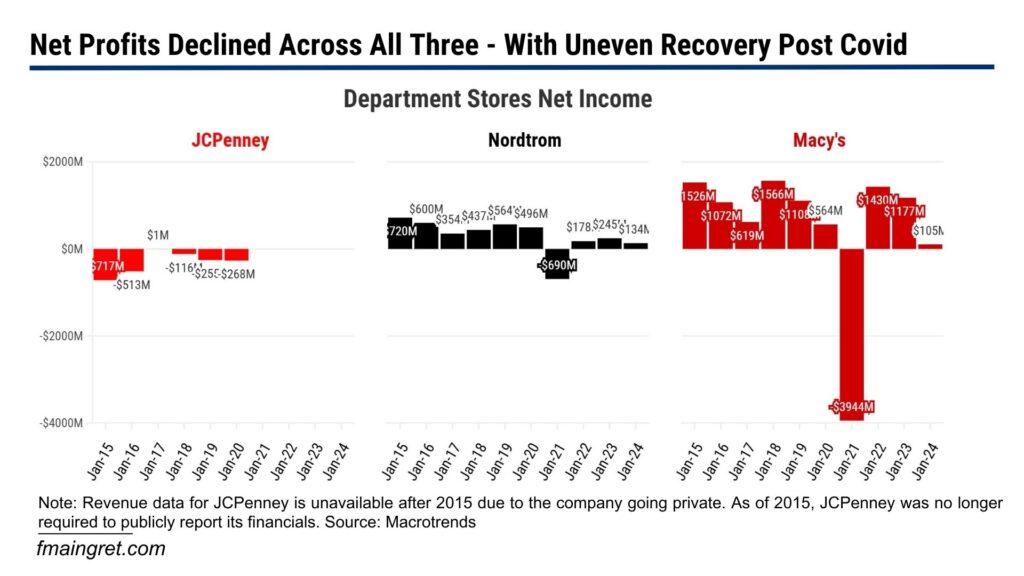

First, the number of department stores in the U.S. has changed over the years, with a general downward trend in recent history. In 2021, there were 4,540 department stores, slightly increasing to 4,559 in 2022. However, total sales by U.S. department stores are expected to fall from $103 billion in 2018 to only $81 billion by 2026. Major department store chains have announced multiple store closures due to poor performance. Macy’s plans to close 150 stores by 2026, and Kohl’s 27 stores by April 2025.\

Many customers tend to see department stores as outdated, lacking the uniqueness of niche brands, and with price points much higher than fast fashion.

Department stores, including JCPenney, have diluted their brand value by offering frequent discounts and flash sales. This created confusion among customers.

In my opinion, the rise of ecommerce significantly impacted the industry, and department stores were too slow in their reaction. Part of the appeal of department stores was to offer many brands in one location with a large selection of items. But in terms of assortment size, no store can beat what is available directly to customers online within just a few swipes on their phone.

Sure, shopping in stores has some advantages, such as being able to try on clothes to see the fit or get recommendations from a sales associate. But in 2025, technology allows for accurate size charts, high-quality visuals, and even the use of AR or AI in some niche cases. Returns tend to be easy, and in many cases, free of charge. Delivery speed has increased since the early days of ecommerce, making the shopping experience more convenient than ever.

But the advantages of ecommerce go beyond selection and logistics. Progress with AI has resulted in better UI and chatbots, sometimes able to provide very accurate, personalized recommendations and assist customers shopping online. Finally, the abundance of sales channels makes it easy for customers to compare prices, as opposed to the confusing pricing strategies of some department stores.

Sadly, I think department stores were too slow to adapt to ecommerce, marketplaces, and the latest trends in digital marketing. Their size and complexity probably made it difficult, but I believe this model would be in a better place today if they had acted earlier.

Why This May Not Reverse the Downward Trend for JCPenney

I find it interesting to see movement in this industry. Unfortunately, while Catalyst Brands offers benefits, it doesn’t address the core structural issues JCPenney and department stores face.

Merging with SPARC doesn’t fundamentally change JCPenney’s outdated business model. I don’t see how it drastically improves the department store model’s value proposition to the point customers would flock to the stores over shopping online. Being part of Catalyst Brands does little to impact branding, and there have not been dramatic marketing plans disclosed yet.

Catalyst Brands may have more customer data to play with, but does it really matter if it doesn’t turn into an actionable plan? At the end of the day, I still feel JCPenney lags far behind more digitally savvy retailers. I’m not saying it would be impossible to catch up, but it’s no easy task.

Conclusion

While the formation of Catalyst Brands may bring some efficiencies and cost savings, it does little to address the fundamental issues JCPenney and other department stores face today. The company’s outdated business model, slow adaptation to e-commerce, and inability to use the latest digital marketing trends put JCPenney at a significant disadvantage.

Despite the merger, I feel JCPenney still struggles to offer customers a good reason to choose its physical stores over the convenience and value of online shopping. While the future isn’t set in stone, I am still skeptical about JCPenney’s ability to recover.