Have you ever wondered how Santa gets gifts to every home so quickly? He’s got a secret weapon: a brown sleigh with the letters U-P-S on the side. When the reindeer are overworked, UPS is out there, making holiday wishes come true. UPS and other carriers will be busy this holiday season, as up to 80% of customers say they plan on shopping online.

But hold on, we aren’t there yet. Let’s take a moment to go over UPS’s Q3 performance. It’s a big deal in the world of e-commerce, and things haven’t quite lived up to what we were hoping for. UPS isn’t just sitting around, though. They’re on the move, making changes and taking action. Let’s jump into the numbers, UPS strategy, and the outlook on the upcoming Christmas season.

Behind the Numbers: UPS’s Q3 Performance

I don’t think I need to introduce UPS. This giant in the shipping industry ships over 20 million packages and documents daily to more than 220 countries and territories. This is significantly more than one of its main competitors, FedEx, with “only” 6 million packages daily.

UPS recently reported their numbers for the third quarter of 2023. Their revenue declined 12.8% from the year-ago period to $21.1 billion. Their consolidated operating profit declined 48.7% over the same period to $1.3 billion. We can also observe a stronger decline in the most recent quarter, as well as a similar decrease in the domestic market, from $15.4 billion to $13.7 billion, with operating profit tumbling down by 66%.

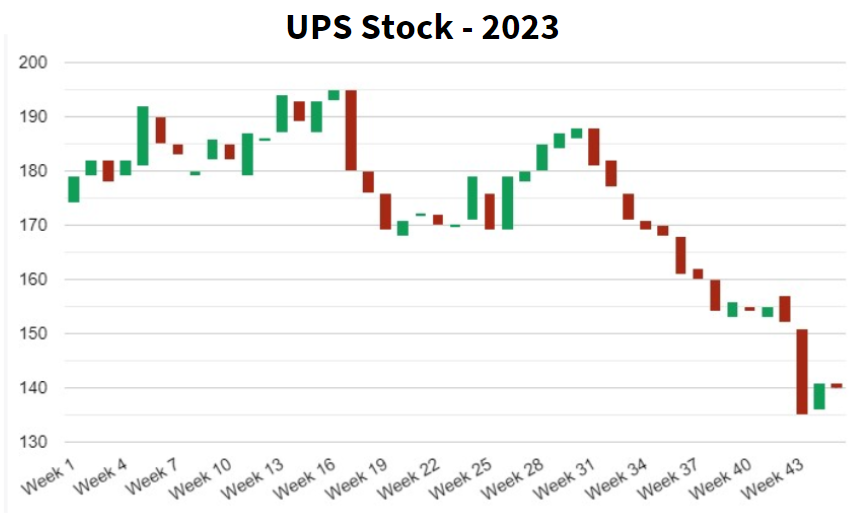

And here’s something for the stock-watchers: UPS stock recently hit a new 52-week low and updated their yearly revenue forecasts, now between $91.3 billion and $92.3 billion, down from its previous projection of $93 billion.

Several performance indicators for UPS are raising concerns. Notably, their reported operating margin sat at 4.2% on the domestic segment, while it should be in the 10-15% range. UPS also reported that their UPS average daily package volume declined by 11.5%. Their margins are drastically better on the international segment, at 14.8%, but that is a much smaller part of UPS revenues.

Volumes were a problem for UPS, partly due to drop during labor negotiations. There was some uncertainty while the new labor contract with the Teamsters was not fully ratified, but UPS is confident volumes will improve and they will regain momentum. A pressing concern for UPS was the notable decrease in higher-margin services, particularly a near 30% year-over-year drop in profitable international shipments. It has been reported that UPS clients favored less expensive shipping options, going with UPS ground over air courier, and some even considered other carriers. In recent years, both UPS and FedEx had hiked their rates amid rising volumes. But as market conditions worsened and shipping volumes have decreased, they had to offer discounts to keep their existing customer base.

2023 was anticipated to be challenging, and it has lived up to that expectation. The company lowered guidance, to $91.7B from $93B. However, UPS is investing in several important initiatives. For example, UPS has a strategic objective to become the number one complex healthcare logistics provider globally. They have made acquisitions, such as Bomi and the announced acquisition of MNX Global Logistics. The company has been expanding its healthcare distribution operation, and plans to open seven new dedicated healthcare facilities in Europe and the US. This is part of their goal of reaching a $10 billion healthcare revenue target.

Beyond some of their other digital transformation, operational efficiency and cost reduction initiatives, I’d like to focus on one I found especially interesting : the acquisition of Happy Returns.

Happy Returns Acquisition and The Cost of Convenience

Online shopping is great, except when you order some stylish-looking clothes that make you look like a clown once you get to try them on. Fortunately, it is now easier than ever to return items. Online shoppers returned $428 billion worth of products in 2020, with an estimated return rate of 15% to 20%.

UPS recently acquired Happy Returns from PayPal, a service that simplifies the process of returning online purchases. It allows customers to return items without a box or label. This service also includes a large network of 12,000 drop-off locations, which, when combined with UPS locations, are often found in convenient places like retail stores and shopping centers. The service is integrated with many e-commerce platforms and retailers, making the process even easier for customers.

While returns are a key part of e-commerce, I wonder about the future volumes of items returned. The Wall Street Journal recently reported that companies pay on average $26.50 to process $100 in returned products. Returns can be very costly for retailers, and as companies pivot from chasing top-line growth to focusing on profits, we might see more of them start to pass these costs onto consumers. Unfortunately for businesses, a recent survey from Invesp has reported that 79% of consumers expect free return shipping, and 74% also stated they would not order from an online store that charged for returns. This puts retailers in a tight spot, having to juggle consumer expectations with the reality of bottom-line impacts. I wrote about product returns earlier this year (https://fmaingret.com/2023/03/how-can-online-businesses-effectively-deal-with-product-returns/), and look forward to seeing how many companies will update their return policies in the near future. If they do, this should have an impact on UPS and the return on investment for the acquisition of Happy Returns.

Ecommerce’s High Stakes: The 2023 Holiday Outlook

Now comes the SuperBowl of E-commerce: the holiday season. With Black Friday and Christmas coming soon, it is certain that volumes of shipments will surpass those of the first three quarters of the year. The real question is, can the 2023 holiday season beat 2022? Deloitte’s retail and consumer products practice says yes and estimates that holiday sales will reach $1.54 to $1.56 trillion during the November to January period. According to a recent release, “Deloitte also forecasts e-commerce sales will grow between 10.3% to 12.8%, year-over-year, during the 2023-2024 holiday season. This will likely result in e-commerce holiday sales reaching between $278 billion and $284 billion this season.”

UPS shares this rather optimistic outlook. Despite the dip in earnings, CEO Carol Tomé stated in a press release that the company is “well-prepared for the peak holiday season.” The company will be hosting its annual “Brown Friday” hiring event, with over 600 in-person and virtual events on Nov. 3rd and 4th. On the other hand, some experts are forecasting a slow holiday season. The definitive outcome remains uncertain, but one thing is clear: this will be a major event for E-commerce players.