It’s a rare day when I don’t see complaints about the fees Amazon and other platforms charge. And I understand, the cost of doing business online is becoming unsustainable for many SMBs.

Is the solution to emulate China’s e-commerce regulator and ask platforms to charge reasonable fees and better support small businesses?

Would that encourage people to start businesses and innovate, or would that create even more clutter on these marketplaces? Not to mention how complex this would be from a legal standpoint.

Ideally, we would be able to see new sales channels emerge, with more reasonable fees, that would allow SMBs to breathe. But network effects make it very difficult for new entrants to grow. And it looks like whenever a platform reaches a critical size (Amazon, Walmart, eBay…), it aligns its fee structure close to the ever-increasing industry standard. I am not saying there is price fixing among e-commerce giants, but this creates a very difficult environment for sellers.

What is the solution? At a large scale, I don’t know. At a smaller scale, it is more important than ever for businesses to create products and services that have healthy margins and don’t only rely on sales channels they don’t fully control.

Tag: marketplaces (Page 1 of 3)

Recently, Ulta Beauty announced plans to launch a marketplace featuring beauty and wellness products. Earlier this year, Best Buy opened its own marketplace. Large retailers are turning to this model, from Urban Outfitters to Michaels.

There are several reasons why they would do so: increasing revenue through sales and advertising fees, gathering valuable market data, and of course expanding their assortment without holding more inventory.

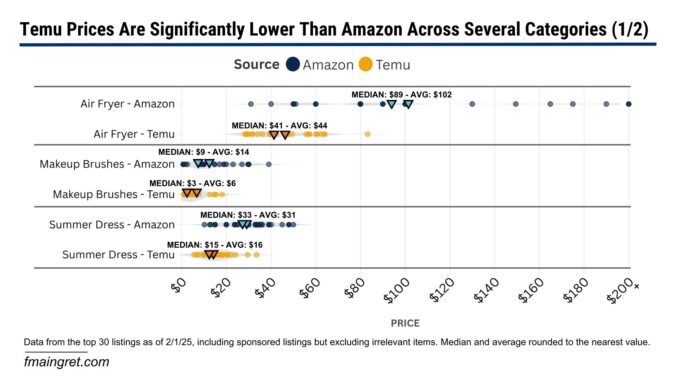

If you ask your friends and family whether Temu is cheaper than Amazon, I guarantee everyone will say yes. But how much cheaper are we talking about? 10%? 50%? I was curious to figure this out, and it was difficult to find relevant data. I was not interested in looking at the marketplace as a whole because no one does 100% of their shopping on Temu or Amazon. Instead, I looked at specific items people might be shopping for and compared the prices between the two marketplaces.

Another thing you’d hear from your friends is that items from Temu take a very long time to arrive. However, for over a year, Temu has had plans to open warehouses in the U.S. and Europe. The company stated that “it will eventually process as much as 80 percent of European sales through these local warehouses.” Did Temu really follow through, or are most purchases still shipped directly from China?

Temu vs Amazon – By How Much is Temu Cheaper?

The methodology I used is pretty simple. I searched for six different keywords on both platforms. For each keyword, I compared the prices between Amazon and Temu for the top 30 results, including sponsored listings but excluding irrelevant results.

At first glance, it is obvious that Amazon tends to be more expensive. For every search term, both the median and the average price on Temu are significantly lower than on Amazon.

Another interesting fact is that Temu’s prices seem to be concentrated in the lowest values, while the spread for Amazon prices is much wider. This is due to Temu shoppers mostly looking for the best deals on off-brand items, while Amazon has a mix of unbranded and branded products at premium prices. Another reason is that Temu’s algorithm may have a stronger tendency to push higher-priced items down the search results, while Amazon allows higher prices in the first search results if the sales volume and velocity are high enough or if they are sponsored listings.

Where Does Temu Ships From?

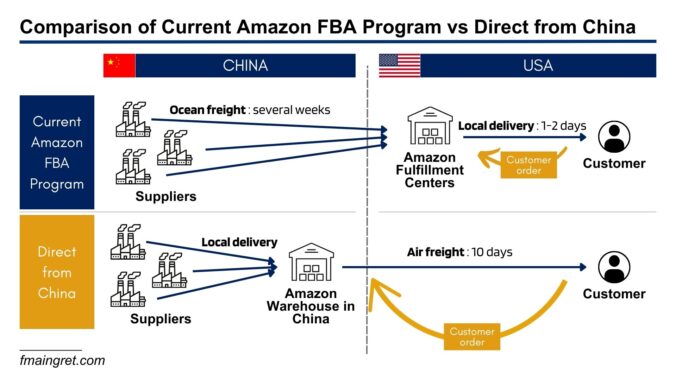

For a long time, Temu shipped directly from China, using the de minimis rule and postal agreements to minimize duties and shipping costs. While Amazon is experimenting with the direct-from-China model with Haul, Temu announced over a year ago its plans to open local warehouses to ship domestically. So for our six items, where do they come from?

I was very surprised that for each search term, the majority of products on Temu shipped from local warehouses with very reasonable delivery times (seven days, sometimes less).

Of course, Temu did not stop shipping from China. If you scroll down long enough, you’ll see a lot more items shipping from overseas. But it is clear that they prioritize local products at the top of the search results. This could be because these orders are more profitable for them, but also because customers are pushing for faster shipping, even if prices are a little higher. Speaking of pricing, it is interesting to note that even though most items now ship from local warehouses, prices are still much lower than on Amazon (see charts above).

Conclusion

Temu is cheaper than Amazon, but the real question is—by how much? Based on the data, Temu consistently offers lower prices, with its products concentrated in the lowest price ranges, while Amazon sells a wider spread that includes premium brands.

Delivery times on Temu have also improved now that the majority of first-listed products now ship from local warehouses. While Temu still relies on overseas shipping for some items, the platform is clearly prioritizing speed alongside affordability. In conclusion, Temu isn’t only cheaper, it’s evolving fast, maybe becoming a more competitive alternative to Amazon than most people would expect.

I’ve made many questionable investment decisions over the years, but buying Walmart stock is not one of them. Don’t worry, I’m not here to give personal finance advice, but rather to talk about the retail giant and how it compares to the current king of ecommerce, Amazon.

For many years, Amazon has dominated the ecommerce world, performing much better than all of its competitors. But 2024 was different: Walmart is no longer flying under the radar and is getting more attention from marketers. But how big is it really?

Continue reading

Amazon Plans to Facilitate Direct Shipping from China: Are Temu and Amazon Two Sides of the Same Coin?

Right before taking a vacation, I saw the news about Amazon planning to assist sellers based in China to ship directly to US customers, similar to what Temu does. While I recognized the importance of this move, the news didn’t surprise me. It’s been clear that China-based sellers have become a key part of Amazon’s strategy. We’ve seen several moves in the past to help Amazon compete with Temu and Shein, so this isn’t entirely new.

However, this might be Amazon’s boldest move to date. My initial thought was, “Some Amazon sellers are in big trouble.” After discussing this shift, I’d like to reflect on the convergence between Amazon’s and Temu’s strategies and review the potential impact on US-based sellers.

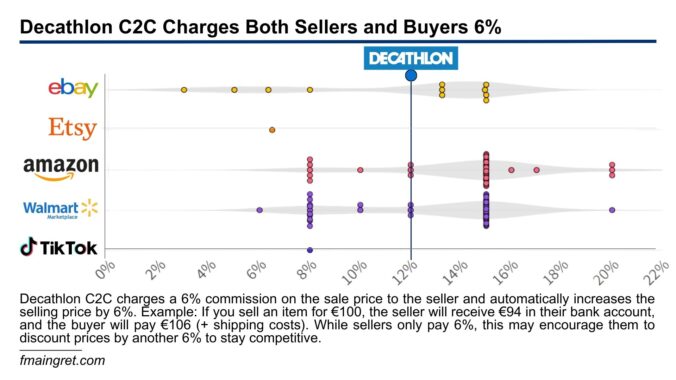

Continue readingI can’t help feeling angry when I see people throwing out perfectly fine products just to make room for new stuff. Not that I worry about them making easy money from reselling the items, but because of the waste of resources involved, especially when there are so many online resale platforms available. Many focus on fashion-related items, but we are starting to see more for other products. Only a few days after posting about Shein’s resale product, I read about the sport retailer Decathlon’s new resale platform for their products. And I thought, it is about much more than just pricing. Thinking about it, I can see many more reasons why companies are starting their C2C resale channels.

Continue readingIf you missed the big news about Walmart this month, here it is: their earnings surpassed expectations, and the company hit a major ecommerce milestone with $100 billion in sales last year.

This announcement prompted many ecommerce managers and executives (I certainly did) to reflect on their strategy regarding Walmart.com and if their plan was appropriate.

It is true that overlooking Walmart is easy these days. Amazon is still the king in the ecommerce realm, and flashy new entrants like Temu or Shein are being extremely aggressive in their marketing. And Walmart is in this awkward space where its ecommerce operations are too big to be completely ignored, but too small to be a company’s main focus (I get approached by Amazon agencies every day, but they very rarely mention Walmart).

Continue readingFor some people, going to Target to buy a loaf of bread and returning with $300 worth of clothes and home decor is a familiar scenario. The addiction to Target is real and might become more intense for some. Bloomberg reports that the company is considering offering a paid membership program as early as this year. Should they launch it, this program would be another competitor for Amazon Prime, Walmart Plus, and Costco memberships. However, Target is late to the party, many years after its competitors. Would proceeding with the project make sense for the company, or would it be doomed to fail? Ultimately, should e-commerce entrepreneurs keep an eye on this program?

Continue readingHave you found yourself needing a toaster-shaped desk lamp? How about a $1.28 keychain stapler? Or a 200-pack of men’s ankle socks? If so, I’ve got you covered. Temu has it all, and quickly became one of the most downloaded shopping apps in the US, offering millions of relatively inexpensive products shipped directly from China, targeting low-income Americans.

In recent news, Temu announced they would open their marketplace to US and European sellers. While this sounds like an obvious way to expand their operation, this information surprised me and made me wonder about Temu’s long-term strategy. Will they still pursue low-cost items, or are they attempting to diversify their offer?

Continue reading