It’s a rare day when I don’t see complaints about the fees Amazon and other platforms charge. And I understand, the cost of doing business online is becoming unsustainable for many SMBs.

Is the solution to emulate China’s e-commerce regulator and ask platforms to charge reasonable fees and better support small businesses?

Would that encourage people to start businesses and innovate, or would that create even more clutter on these marketplaces? Not to mention how complex this would be from a legal standpoint.

Ideally, we would be able to see new sales channels emerge, with more reasonable fees, that would allow SMBs to breathe. But network effects make it very difficult for new entrants to grow. And it looks like whenever a platform reaches a critical size (Amazon, Walmart, eBay…), it aligns its fee structure close to the ever-increasing industry standard. I am not saying there is price fixing among e-commerce giants, but this creates a very difficult environment for sellers.

What is the solution? At a large scale, I don’t know. At a smaller scale, it is more important than ever for businesses to create products and services that have healthy margins and don’t only rely on sales channels they don’t fully control.

Category: News (Page 1 of 7)

Recently, Ulta Beauty announced plans to launch a marketplace featuring beauty and wellness products. Earlier this year, Best Buy opened its own marketplace. Large retailers are turning to this model, from Urban Outfitters to Michaels.

There are several reasons why they would do so: increasing revenue through sales and advertising fees, gathering valuable market data, and of course expanding their assortment without holding more inventory.

You may have heard recently about Amazon overtaking Walmart’s revenues for the first time.

But Walmart is far from being out of the game; I would say they are a serious competitor in ecommerce.

In 2024, Walmart delivered five billion items on the same day they were ordered, twice as many as in 2023. Amazon does not communicate its numbers, but the growth is impressive.

I don’t think tariffs alone will be enough to kill Temu, and I’ve written about how the company has adapted. But there’s another Chinese giant selling large volumes to the U.S.: Shein.

Looking only at revenues, you’d think Shein is in great shape, with a 19% increase in sales, reaching $38 billion. However, the company saw a significant profit decline in 2024, with net income dropping by nearly 40% to $1 billion—which may have delayed its IPO.

Over the last few years, Amazon has been throwing s**t at the wall to see what sticks. Not everyone can be Amazon, but not everyone can be TikTok either. So, I’m not surprised to see that Amazon is shutting down Inspire, their TikTok-like feed of shoppable videos posted by influencers and brands.

As Paul Drecksler explained in a recent post, people go to TikTok for entertainment, not just with the intent to shop, and Inspire lacked the entertainment part. I believe very few people are looking for Amazon’s version of QVC, and many people tend to rely on existing social media for product discovery.

Another reason for this failure, in my opinion, is the lack of influencers on the platform. People want to see content from their favorite creators, and Amazon struggled to attract talent. They were mocked for the low rates they offered: at one point, Amazon said they would pay influencers $25 per video, with a payout cap of $12,500 for influencers submitting up to 500 videos.

Amazon is great for capturing customers at the bottom of the funnel, but when it comes to product discovery, I think there’s a lot of progress to be made. Maybe a partnership or an acquisition would work better, because I don’t see how they could turn their shopping app into a media platform that can compete with TikTok or Instagram.

Based on this article from PYMNTS: https://www.pymnts.com/news/ecommerce/2025/66-of-consumers-look-for-free-shipping-when-online-shopping/

What stood out to me more in this report were these findings: “48% of consumers prefer online marketplaces for this very reason”, and among those who made most of their recent purchases on marketplaces, only “18% said better prices are the key factor”.

While pricing is important, customer perception matters just as much. A $30 order with free shipping may often feel like a better deal than a $25 order with $5 shipping, even though the total cost is identical.

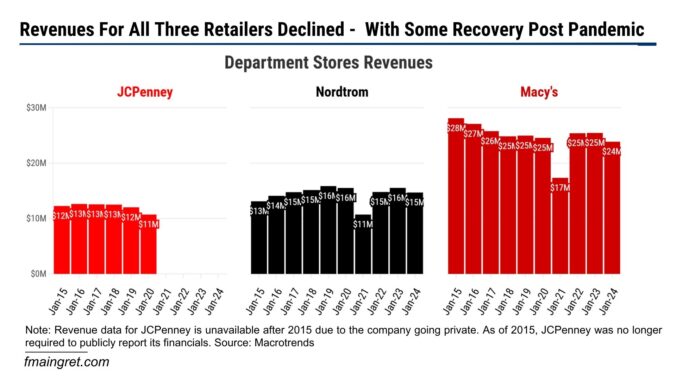

Are we about to see department stores return to their former glory, or are they a relic of the past? Only time will tell. However, reading business news makes me a little pessimistic about their future. Maybe I missed something big here, but the latest news on JCPenney led me to think the company won’t make a comeback anytime soon.

Continue readingAs a customer, I found that AI-chatbots can sometimes be very convenient, but many times a nightmare to deal with. So I was skeptical when I read in an article I won’t link here that “AI-powered chatbots played a key role in boosting online sales during the 2024 holiday season”.

Convenience alone doesn’t necessarily equal increased revenues, not to mention these are often implemented as a cost saving measure by companies. While chatbots might help speed up simple tasks like tracking an order or processing a return, they still aren’t there when it comes to complex inquiries and making sales.

Are these AI-driven tools really boosting sales because they improve the customer journey—or would the customer have purchased the same items through a different journey? And what’s the long-term impact on brand loyalty when customers are left frustrated by unhelpful bot interactions?

I have no doubt that AI has a ton of potential in ecommerce, especially with product discovery and personalization. But retailers should find the right balance between authenticity and the use of AI. No customer wants to deal with an AI when trying to buy something, and feel like they are trying to reach customer service but the AI won’t let them talk to an actual employee.

I’ve made many questionable investment decisions over the years, but buying Walmart stock is not one of them. Don’t worry, I’m not here to give personal finance advice, but rather to talk about the retail giant and how it compares to the current king of ecommerce, Amazon.

For many years, Amazon has dominated the ecommerce world, performing much better than all of its competitors. But 2024 was different: Walmart is no longer flying under the radar and is getting more attention from marketers. But how big is it really?

Continue reading